- PEPE dropped 13% this week, driven by market-wide panic and weak buying momentum.

- Exchange outflows and volume spikes hint at quiet accumulation despite the dip.

- Derivatives show mixed signals, with longs liquidated heavily amid high volatility.

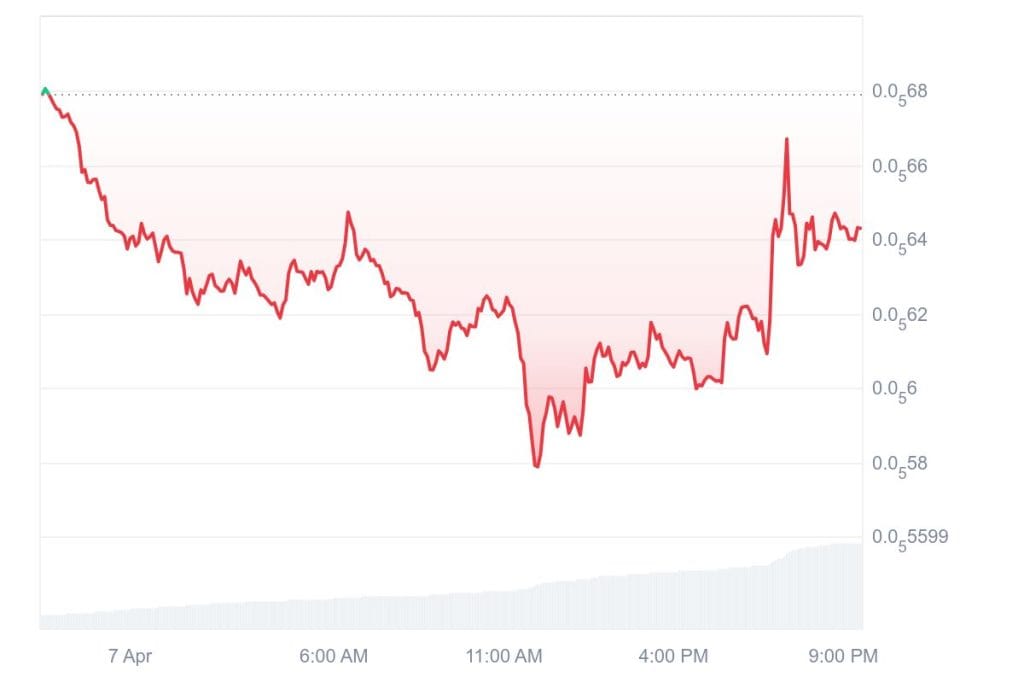

Pepe (PEPE) has dropped 13.02% over the past week. Over the past 24 hours, PEPE has experienced a decline of approximately 7%, with its price fluctuating between an intraday high of $0.000000651 and a low of $0.000000537 currently trading at $0.000006430. This marginal movement suggests a period of consolidation, with the community reacting 80% for bullish momentum.

The current market capitalization stands at $375.3 million, reflecting a decrease from previous levels. In the last 24 hours, the trading volume has spiked 456% which implies there is a jump in the market activity too.

Throughout the past week, PEPE has demonstrated strength, making rebounds from lows previously and approaching key resistance levels. Interestingly, there is a lot of important exchange outflows, which include $4.2 million of PEPE expelled from organized trade on September 26. The movements often signal to growing investor confidence and would indicate that there is a good chance of a bullish movement ahead.

PEPE Token Sees Recovery Amid Market-Wide Sell-Off

Whereas PEPE continues to trend lower due to broader market weakness resulting from recent macro developments. Investors across financial and crypto markets are losing their fear and exiting high-risk assets, including meme coins. The price drop for PEPE shows that its investors suddenly lost interest in the market sell-off phase.

The price movement on the PEPE/USDT 1-hour chart still signals a minor recovery from oversold conditions. A short term bounce from the current position of the token is seen only a bit above the lower Bollinger Band. The price is, however, still below the 20-period moving average, indicating that bearish pressure is in the market.

A Relative Strength Index (RSI) value is 39.39. The set is oversold, but it has risen above the basement of the neutral 50. This indicates weak buying momentum. Right now, this is not a situation of a press odor that would be a reading above 50, which, at least at this point, would be a signal of a potential swing in short-term sentiment.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows initial signs of a potential bullish crossover. The MACD line is crossing down the signal line, histogram bars are becoming lighter. The current momentum in the underlying condition, however, does not bode too optimistic on the prospects of a breakout.

Derivatives Market Shows Mixed Sentiment

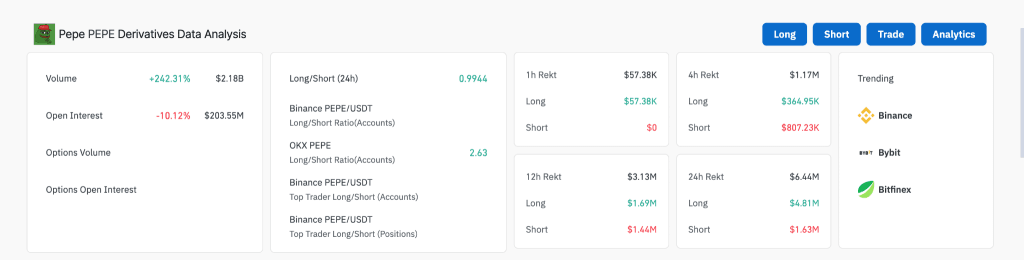

Over the past 24 hours, trading of PEPE has soared in the derivatives market by over 242.31% to $2.18 billion. According to Coinglass data, the open interest is down 10.66% from the previous trading session, falling to $203.55 million. The contrast suggests that the traders are either exiting their positions or have had to exit them as countervailing price volatility has climbed.

Currently, the long/short ratio for the crypto market is near neutral at 0,9778, meaning there is a balanced sentiment. Still, the trading activity on OKX is different, as the ratio here has skyrocketed to 2.79 meaning a strong lean towards long positions. Indeed, this implies growing bullishness, but it also means further risk to the downside for those betting on a price rebound should the current downtrend extend.

There were $5.70 million worth of crypto positions liquidated in the last 24 hours. However, long positions represented a significant $4.85 million of the total while short traders had suffered losses of $851,000. But these numbers show too many were not ready for the intensifying sell-off and some traders placed themselves to be traders in a market rally.