- Pepe (PEPE) shows strong bullish momentum, with technical indicators signaling a potential breakout toward the $0.000015 target.

- Despite negative sentiment among large holders, MACD and RSI suggest an upward trend within a falling channel breakout setup.

- Analysts eye $0.00001584 as a key price target, contingent on overcoming psychological resistance at $0.000010.

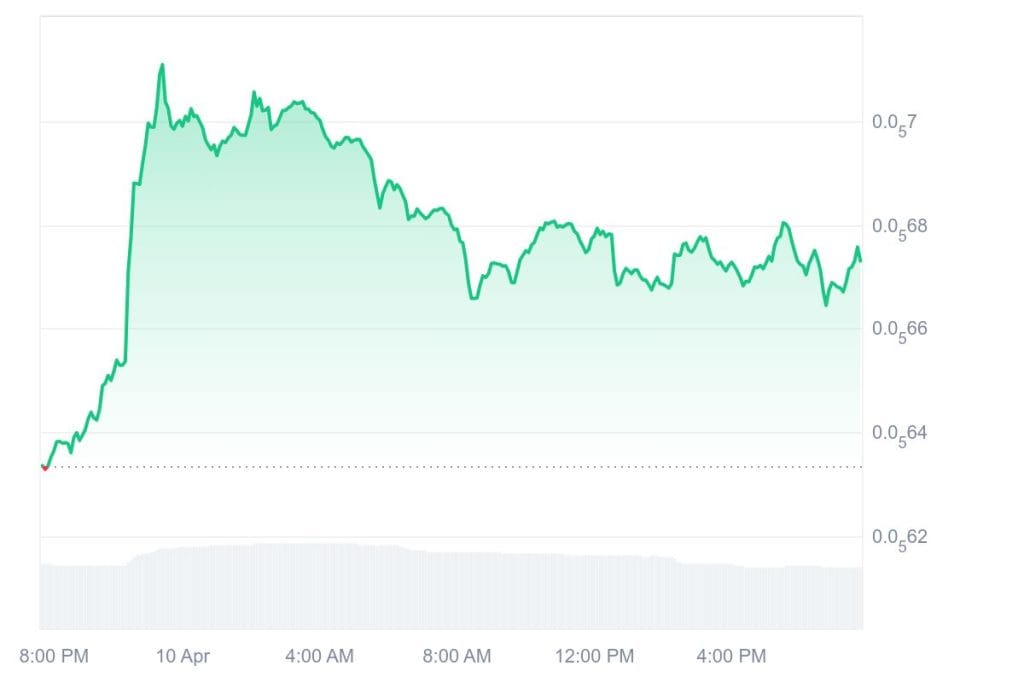

As of April 10, the cryptocurrency market shows positive momentum through which meme coins have rebounded, especially with Pepe taking the lead position. On Wednesday, the token achieved a 15% increase for a spot among top-performing virtual currencies in its sector.

Since its successful rally, PEPE rose by 5% and is moving towards an essential resistance barrier. The combination of MACD and RSI technical indicators indicates robust bullish momentum, which strengthens predictions about a breakout possibility.

Market analysts follow the ongoing situation because they believe a falling channel breakout will take place. Investors wonder if Pepe will leverage its positive market momentum to breach the $0.000015 price point.

Pepe Price Analysis: Bullish Signals Emerge Despite Bearish Sentiment Among Large Holders

An unmistakable resistance trendline exists within Pepe’s daily chart thereby creating a dropping channel which controls current price movements. The Pepe token experienced substantial market decline which started at $0.000026 before reaching its minimum point of $0.0000052 inside this specific price channel.

Pepe entered a flat range after its descent, but its price reached the highest point of this downward pattern. The move suggests potential bullish reversal conditions because expanding market improvement factors support an increased likelihood of breakout upward rallies.

Several technical analysis indicators confirm that the market will move in a bullish direction. The MACD indicator approaches a cross above the signal line, and the daily RSI shows bullish divergent patterns, which are usually interpreted as bullish signals for future price rises.

Large Holders Netflow Paints a Contrasting Picture

Technical indicators show optimism, but major wallet owners keep a negative outlook on the market. According to IntoTheBlock data, major wallets have demonstrated declining netflow figures for the past month.

Big wallet addresses registered 309% less netflow throughout this week, and their cumulative netflow decrease amounted to 170% since the previous month. The overall bearish forces intensified on April 9 as daily netflow dropped by 727.46 billion Pepe tokens.

Pepe Price Targets: Breakout Rally in Sight Amid Bearish Sentiment

The prevailing bearish atmosphere across markets does not affect Pepe’s large holder netflow, which persists in negative figures. Expert analysts believe that a potential rally could improve the confidence levels of investors who hold major amounts of Pepe tokens.

The technical analysis using Fibonacci retracement levels predicts a $0.00001584 target value, which corresponds to the 50% Fibonacci retracement level after a channel breakout occurs. The price target of $0.00001584 depends on Pepe breaking through $0.000010 since it represents psychological resistance. The resistant value of $0.0000050 functions as an essential psychological barrier that continues to protect the market.