- SEC’s 2025 roundtables signal a shift to dialogue, intending to balance crypto innovation with investor protection.

- Tokenization and DeFi discussions highlight the SEC’s focus on merging traditional finance with digital assets.

- Resolved cases like Ripple and Immutable show the SEC easing enforcement for a more cooperative crypto approach.

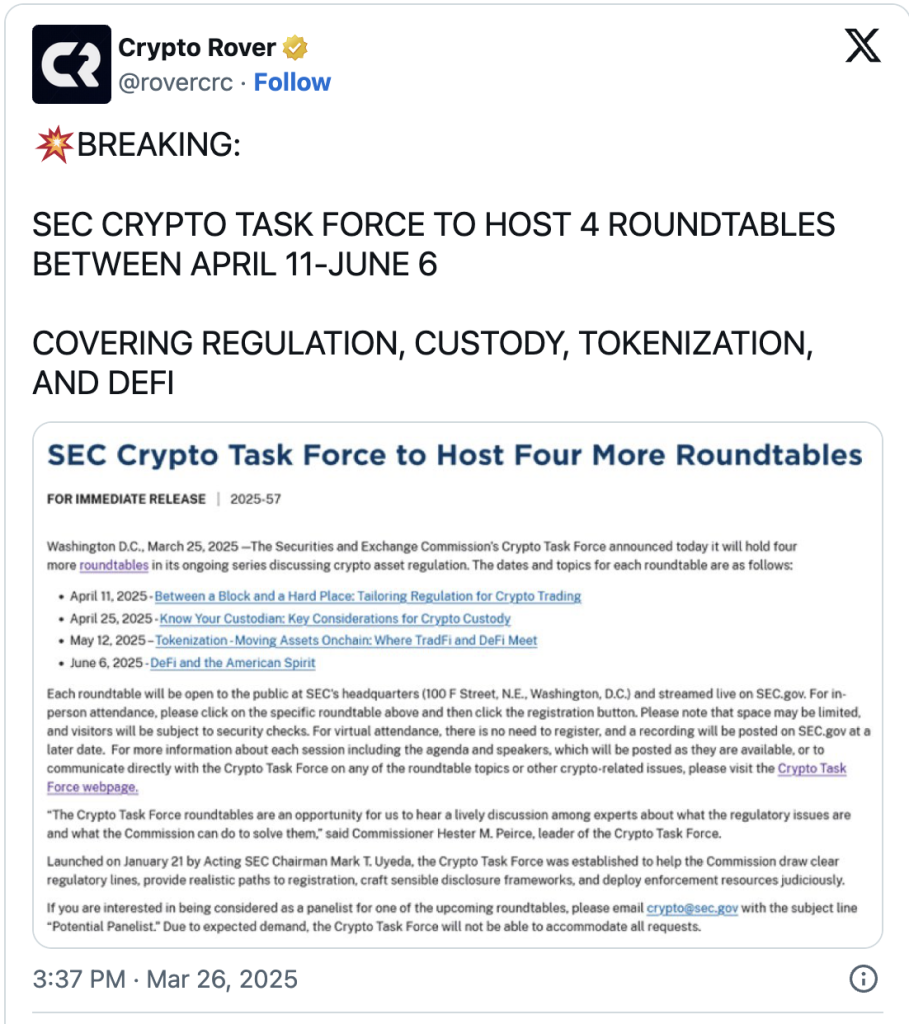

Through its specialized Task Force, the SEC is working to clarify the crypto regulations. The government intends to have four roundtable sessions from April to June 2025, departing from its prior enforcement strategy.

These gatherings are intended to discuss important issues. Besides, they aim to demonstrate the SEC’s readiness to communicate openly with industry participants instead of only pursuing legal action. The change points to a more cooperative strategy for determining how crypto legislation will develop.

SEC Expands Crypto Regulation Talks with New Roundtables

Commissioner Hester Peirce will lead the SEC’s Crypto Task Force in organizing four roundtables. These events will focus on trading rules, custody standards, tokenization, and DeFi’s impact on finance.

The SEC detailed the schedule on its official website. On April 11, the first session, “Between a Block and a Hard Place: Tailoring Regulation for Crypto Trading,” will start. The second, on April 25, is called “Know Your Custodian: Key Considerations for Crypto Custody” and will tackle asset safety.

On May 12, “Tokenization – Moving Assets Onchain: Where TradFi and DeFi Meet” will explore blending traditional finance with DeFi. The series wraps up on June 6 with “DeFi and the American Spirit.”

All sessions will take place at SEC headquarters, and the public can join in person or stream live on SEC.gov. Additionally, the Crypto Task Force webpage will share agendas and speaker details as they’re ready.

Commissioner Peirce highlighted the importance of these talks, explaining that they bring experts together to discuss regulatory hurdles. The aim is to find practical solutions for the SEC to adopt. Acting Chairman Mark T. Uyeda established the Task Force on January 21, 2025. Its goals include setting clear rules and building fair disclosure guidelines for the crypto space.

The SEC has historically leaned on enforcement actions, and this move could provide a clearer path for crypto regulation. Now, it seeks to engage with the industry through dialogue. Expert Crypto Rover also noted this shift in his X post.

Besides, lately there have been U.S. policy changes, like President Trump’s March 2025 executive order for a crypto strategic reserve. Moreover, the White House also held a crypto summit recently. These actions signal a potential regulatory overhaul.

SEC Concludes Longstanding Crypto Legal Battles

The SEC’s pivot to dialogue comes as the crypto industry breathes easier as the agency wraps up several high-profile cases.

Ripple’s marathon legal battle with the SEC has finally reached its conclusion. Stuart Alderoty, Ripple’s legal chief, announced on X that both parties are moving forward – the SEC withdrew its appeal unconditionally, while Ripple dropped its cross-appeal.

The settlement saw Ripple’s initial $125 million penalty reduced to $50 million, with the remainder set to return from an interest-bearing escrow. The SEC plans to request the removal of a previous injunction.

Last summer’s ruling by Judge Torres brought clarity to XRP’s status. The Judge determined that public exchange sales weren’t securities, though institutional sales did breach securities laws. This nuanced decision helped pave the way for the current resolution.

Meanwhile, Web3 gaming platform Immutable celebrated its victory as the SEC closed its investigation without finding any violations. This outcome, shared through Immutable’s X account, comes after the company received a Wells Notice last year.

This aligns with a broader trend by the administrative agency, where it has held off from pursuing enforcement actions against crypto entities, OpenSea, and Uniswap. Recent regulatory shifts may show that future SEC roundtables may play a part in defining balanced regulatory standards for the crypto industry.