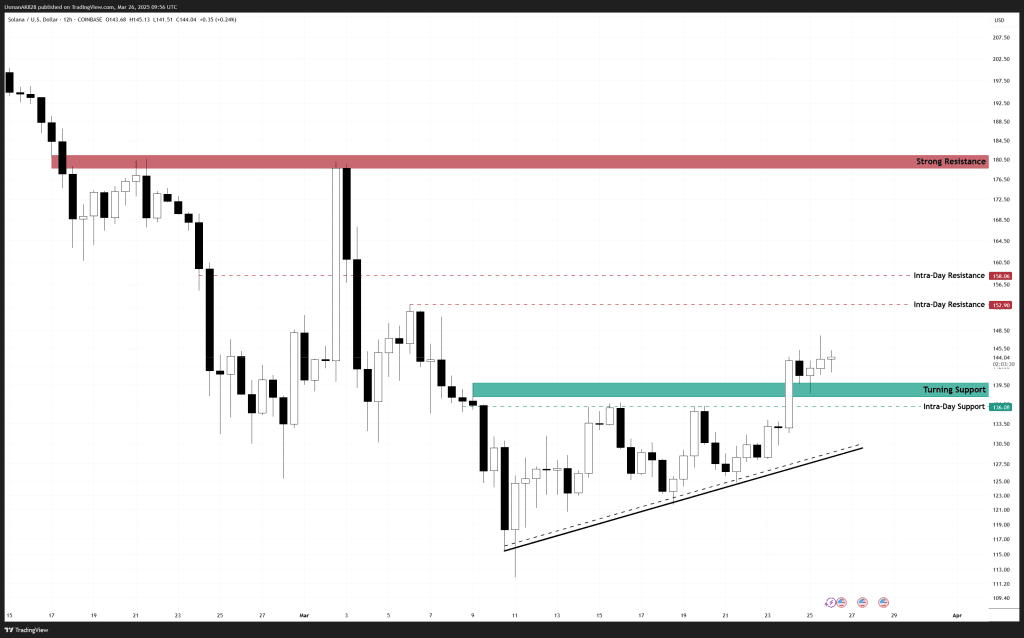

Solana Technical Analysis: 26 MAR 2025

Solana is holding the support firm. Source: TradingView

General View

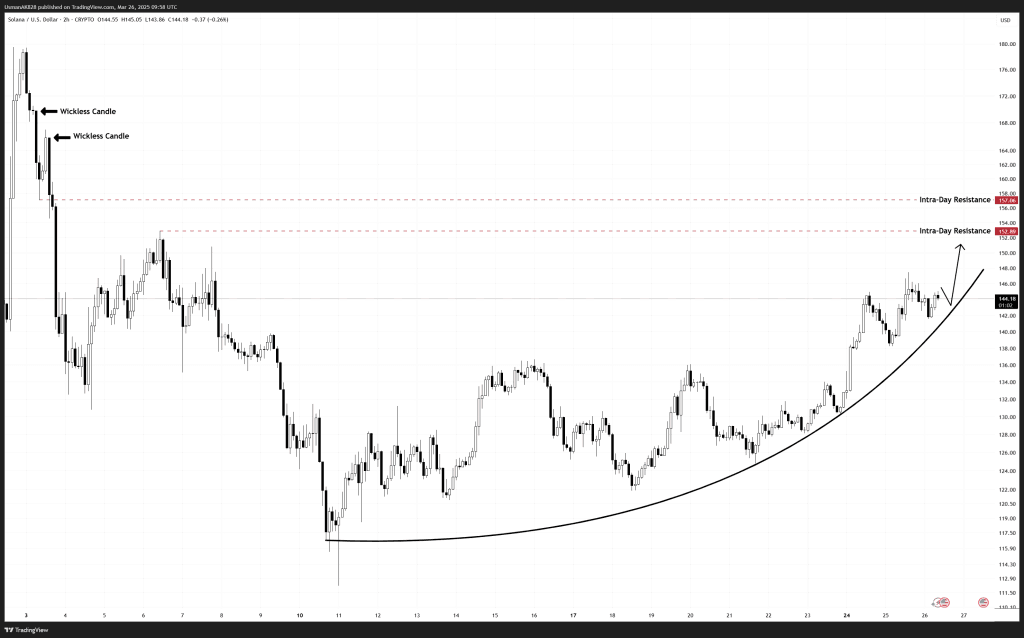

Solana has staged a strong breakout by getting past the immediate resistance zone near $136 to $138 levels. This move follows a series of higher lows, indicating steady bullish momentum. The price is now holding above the key support zone, and notably, Solana has wickless candles at higher levels, signaling inefficiency in price action. Such gaps often act as magnets for price, making them a key target for further upside movement.

On The Upside

In the short-term, bears are creating a round of resistance at the $145 level. For the last several hours, this region has been holding strong. Bulls need to break this level to enter a period of continuation, after which they will be able to aim for $152, followed by $157 next. Momentum needs to remain intact and volume needs to support the move.

On The Downside

The $140 to $136 zone is now a key support level. A dip into this area with a strong rebound would reinforce the bullish case. Bulls need to ideally hold this supportive range to keep the upper hand. A break below these levels could weaken momentum, exposing Solana to a potential drop.

Wickless candles are around $170. Source: TradingView