Solana Technical Analysis: 13 MAR 2025

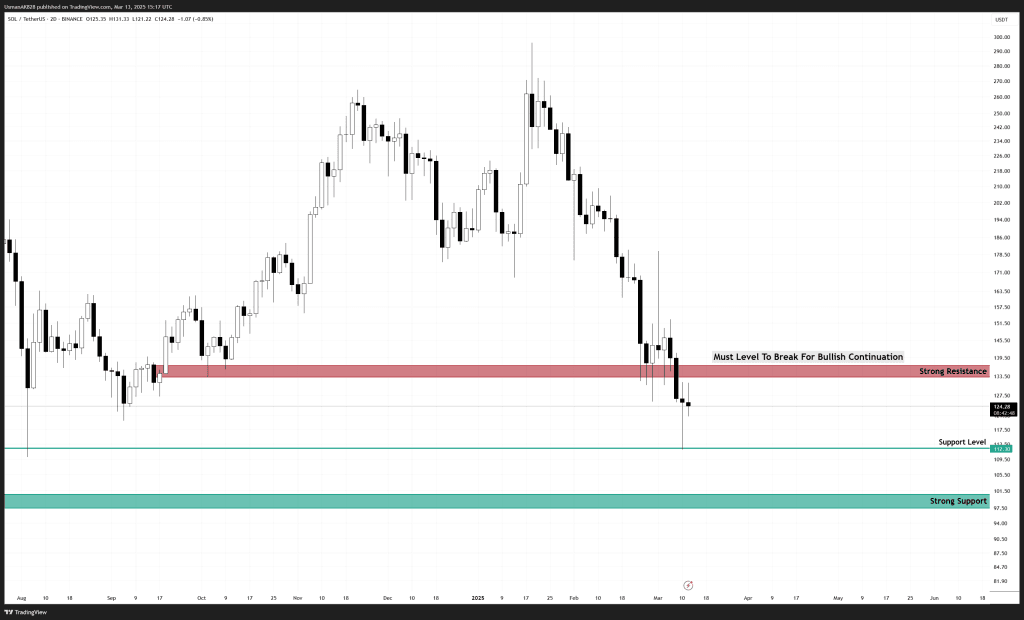

Solana’s 2-Day time-frame chart. Source: TradingView

General View

Since its highs back in January, Solana has been under consistent selling pressure. The price has now lost a key supportive region that was previously holding the trend. If bulls fail to reclaim the key levels in the next few hours, Solana could slide further down. However, if bulls can step up around the current levels, a short-term relief bounce may emerge.

On the Upside

For any meaningful recovery, Solana must reclaim the levels between $133 to $136. This is the region that was previously functioning as a support but now has been transformed into a resistance. If bulls can successfully navigate this hurdle, Solana can easily see a bounce towards the $145 to $150 range, with room for even higher retests.

On the Downside

Meanwhile, over the next few hours, if bulls fail in showcasing their strength, sellers could exploit that moment and drag Solana down to $117.50 to $110 once again. Meanwhile, these supports are unlikely to withstand selling pressure for long and would eventually break, opening the door towards $100 to $97.50 support levels. These supports were last tested in February 2024 and will likely bring up a strong reaction if tested.

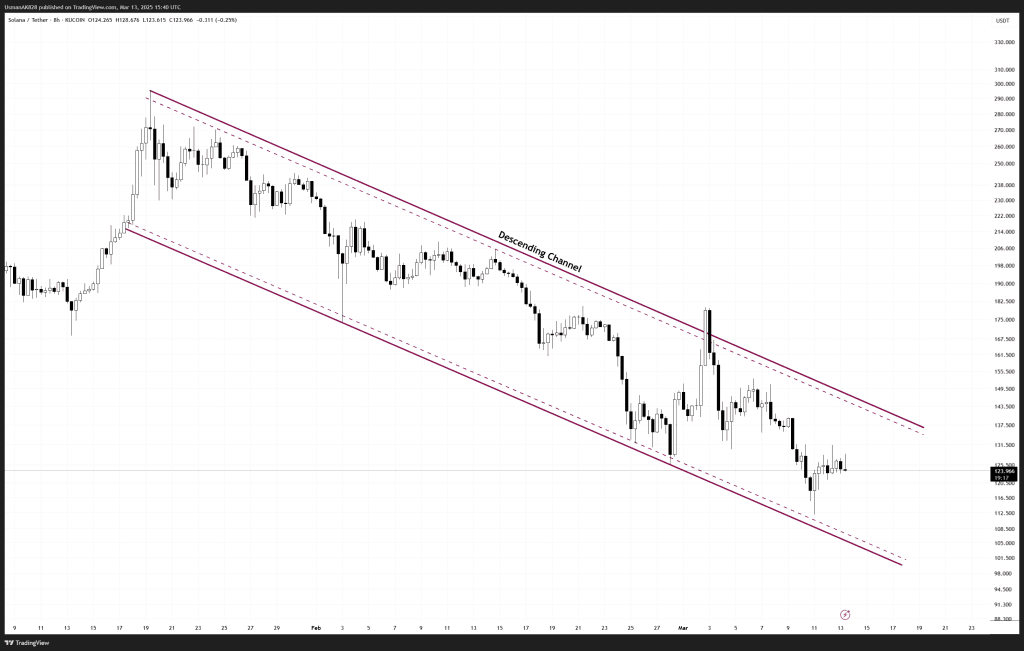

Solana in a descending channel formation. Source: TradingView