Solana Technical Analysis: 9 APR 2025

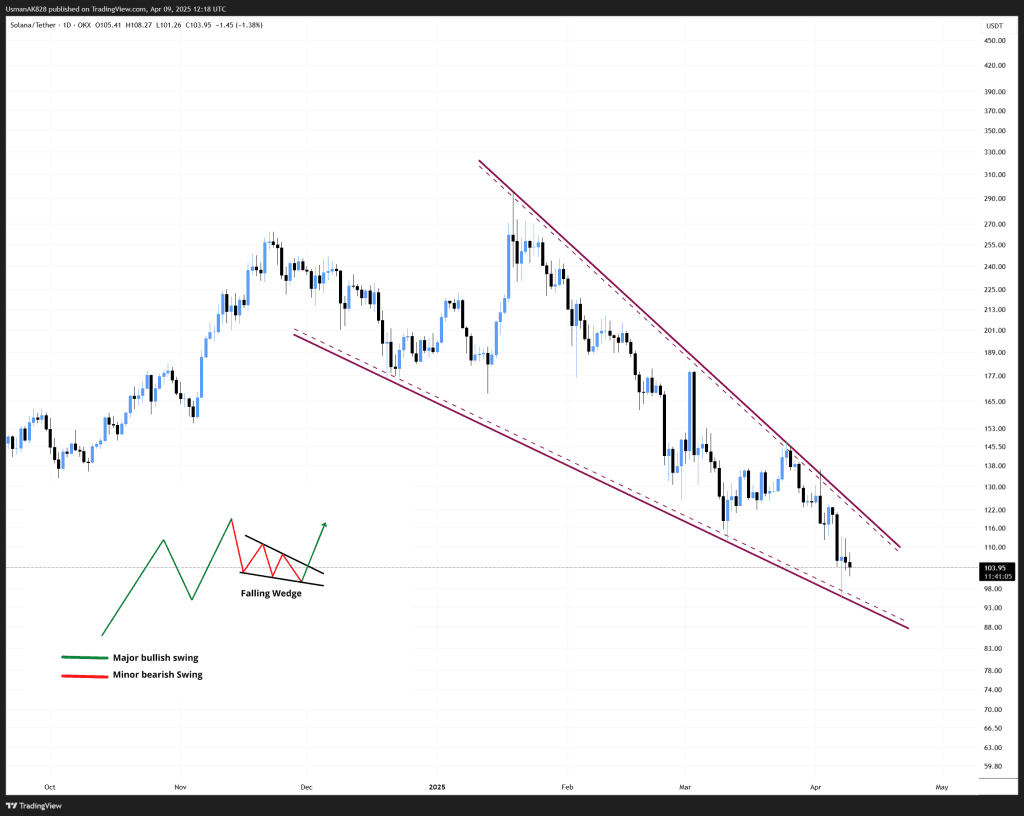

Wedge is starting to hold importance for the Bulls. Source: TradingView

General View

Solana has been sliding steadily after losing the critical weekly support zone. This breakdown invited heightened selling pressure, pushing price into a deeper corrective phase. However, despite the weakness, bears have not yet broken Solana’s structure entirely. Price is still respecting the lower boundary of a well-defined falling wedge pattern. This ongoing compression hints that momentum may be shifting. As long as bulls defend the wedge’s support line, the possibility of a bullish breakout remains valid. A breakout from this wedge could give Solana enough strength to revisit the lost weekly support zone before fresh selling.

On The Upside

Solana’s primary resistance lies at the $105.40 level, followed by $108.20. These levels are likely to be challenging resistances for the session. Meanwhile, if the price finds acceptance above the $108.20 level, the price can then retest the lost weekly supports at $115 to $120 levels.

On The Downside

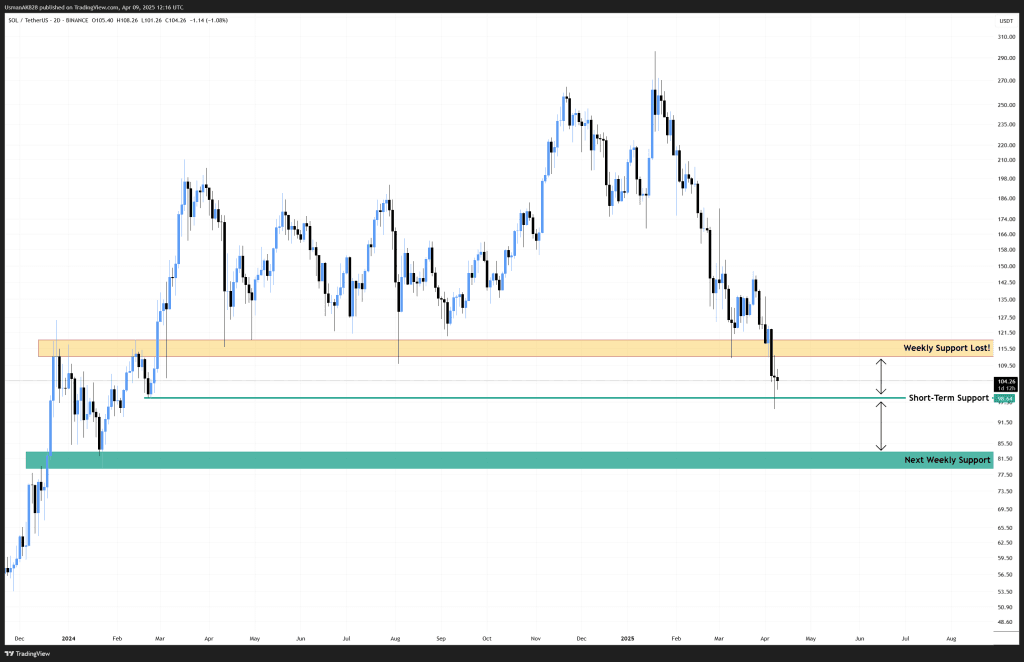

Failure to defend the wedge’s lower boundary could put Solana at risk of accelerating its downtrend. The first level to monitor is the short-term support, around the $98 to $94 level. A break below this could push SOL toward the next key weekly support range. As a result, holding the short-term support of $94 remains entirely important for Solana.

Solana is holding the short-term support level at $98.60. Source: TradingView