Solana Technical Analysis: 16 MAR 2025

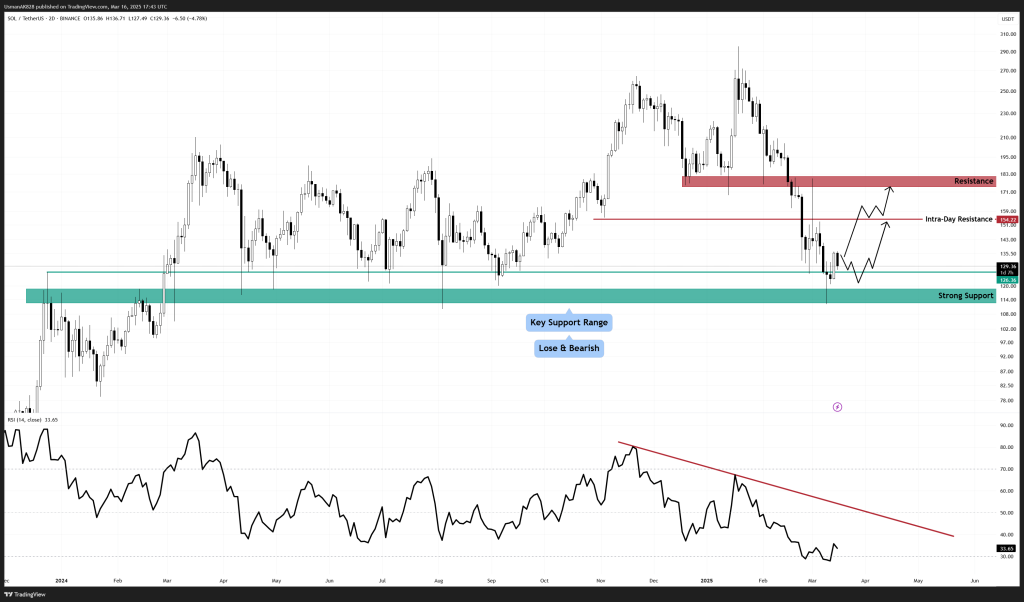

Price respecting the weekly support levels. Source: TradingView

General View

Solana has tested its weekly support levels and has bounced decently. Since this test, the price has been holding fairly well, and if bulls can sustain the pressure and withstand the ongoing selling, a possible week of recovery can’t be ruled out. The RSI is now in oversold territory, which could trigger strong short-covering, adding momentum to the rebound in the sessions ahead.

On the Upside

Bulls are facing tough resistance at the $135 to $137 levels. This range, on the lower time frame, is restricting any upside moves. Solana needs to break this level to extend its upside into the intra-day resistances at $146 and $154. The quicker the price flips past this hurdle, the stronger the move will be, potentially accelerating bullish momentum.

On the Downside

Solana currently has a decent intra-day support positioned at $137.80 and $136.40 levels. Both of these are the primary levels for the day. If the price continues to hold them, Solana will avoid any deeper pullbacks; meanwhile, if sellers overwhelm these supports, a drop back to $120 and lower can’t be ruled out. Expect the session to become volatile in the next few hours.

Solana’s descending channel remains intact. Source: TradingView