- Spot-driven DOGE rally shows strength as leverage plays fade out.

- $0.20 emerges as critical resistance with heavy supply concentration.

- Long-term holders remain steady, supporting market stability.

Dogecoin (DOGE) has steadily recovered its price in the past weeks. On-chain data from Glassnode shows that spot buying is bringing on a recovery instead of leveraged speculation. Funding rates, futures activity, and wallet behavior all suggest the current trend is more organic and less about hype.

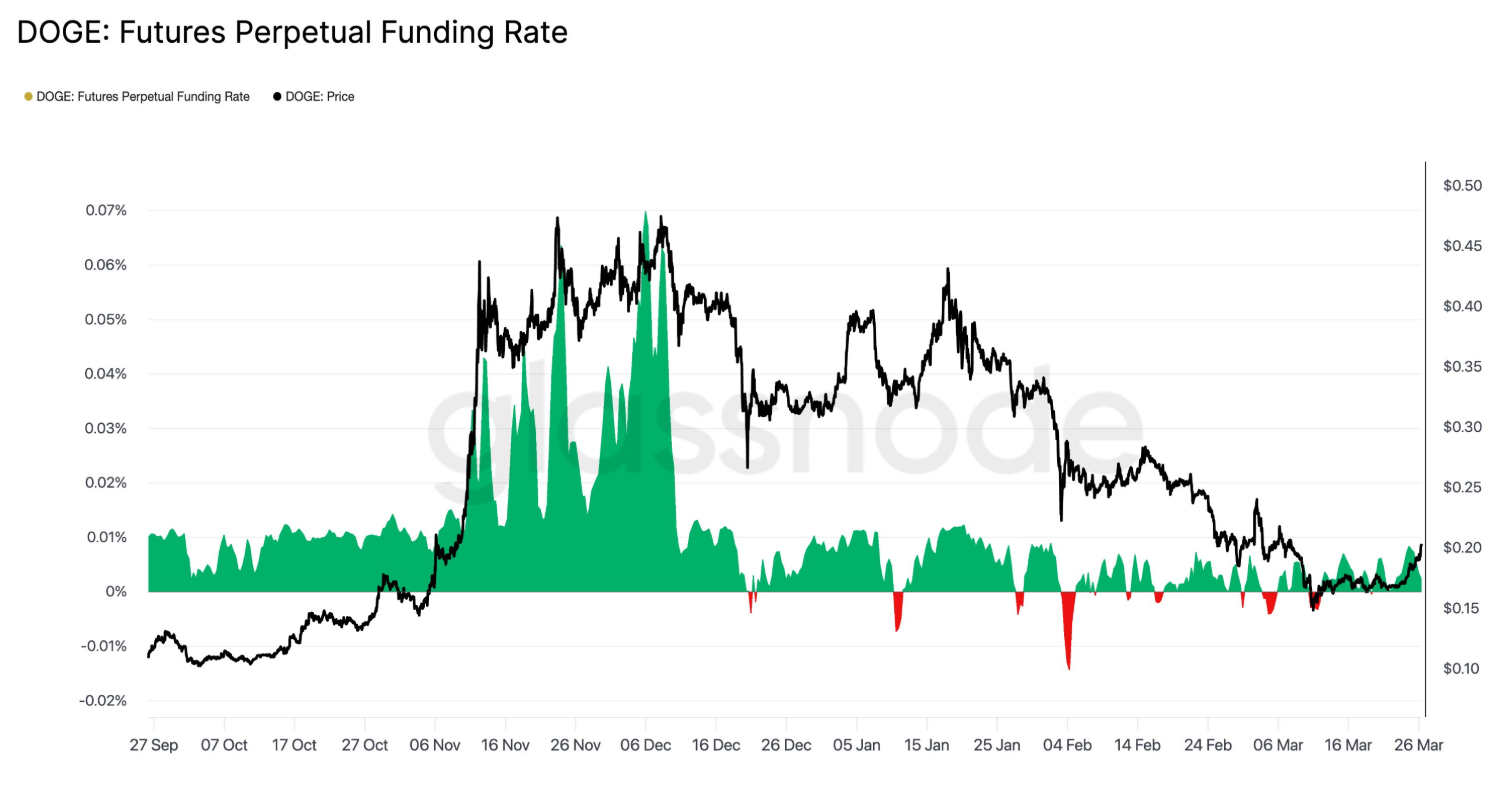

Funding Rates Flat as Spot Buyers Dominate

However, DOGE’s perpetual future funding rates have returned to neutral and are currently nearly 0% after a brief spike earlier this month. Typically, higher funding means that the long traders are using leverage and paying to stay in their positions, but this flat rate suggests a lack of aggressive speculation.

This means spot market demand caused the late price increase in DOGE. Leveraged rallies, however, are more unstable from sharp reversals.

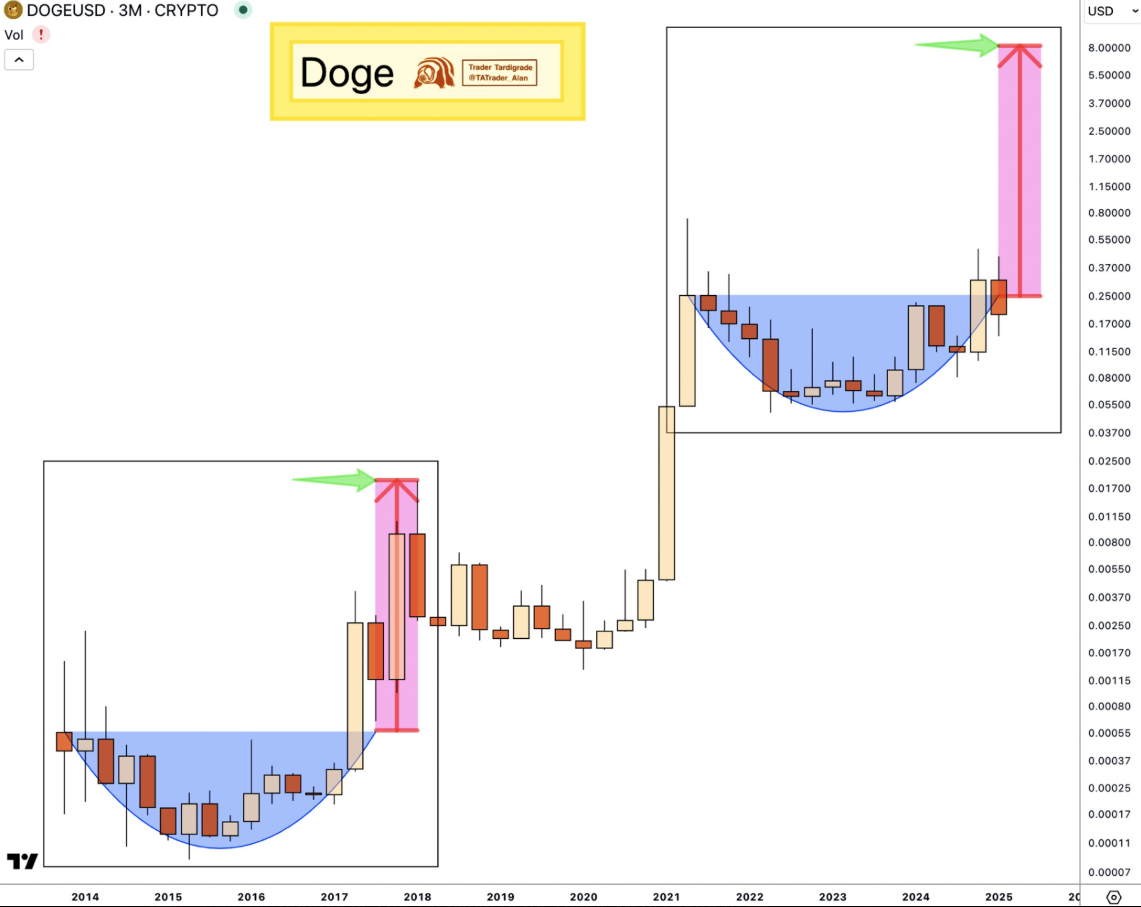

In line with this, analyst charts show a repeat in DOGE’s long-term structure to the technical context. Both are a ‘cup’ pattern followed by a sharp rise. If the current structure repeats, DOGE could aim for $8.00. However, that would depend on strong volume and continued market support.

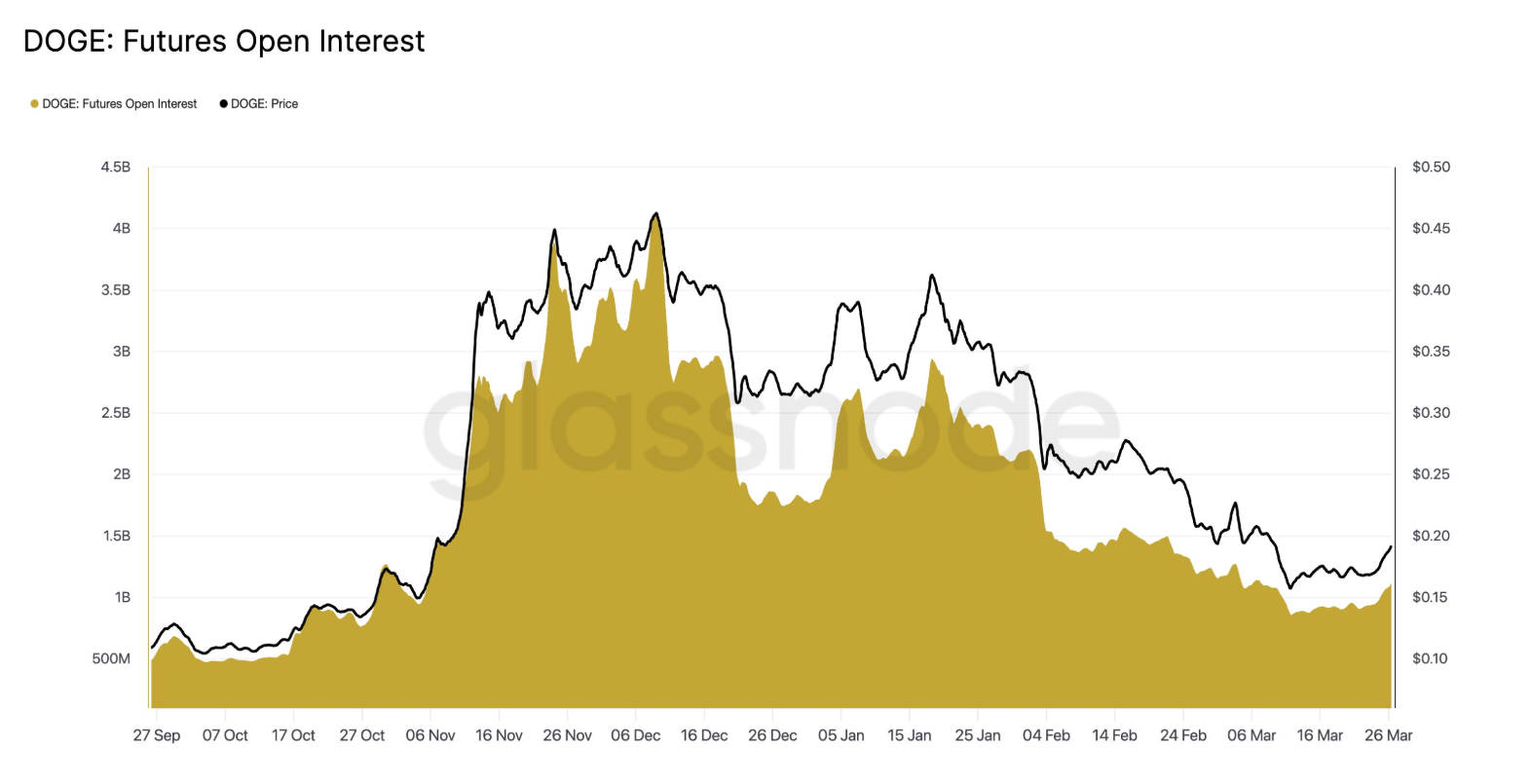

Futures Open Interest Falls, Volume Slowly Rebounds

DOGE futures open interest has plummeted to around $1 billion, while in November and December last year, the total capital locked in the DOGE future contracts was averaging around $3 billion. As a result, this notable decline indicates reduced speculative participation in the market, meaning lower leverage positions are utilized.

The 7-day M.A. for futures volume is climbing, close to October lows. Combined with low open interest and a slow volume rebound, this view reinforces that the current rally is more induced by spot market demand than speculative futures trading. As a result, the price is much less prone to sudden drops due to liquidations.

$0.20 Becomes Key Level on the Chart

According to Glassnode data, 7% of DOGE’s circulating supply was acquired at around the $0.20 price level, the third-largest accumulation zone after $0.17 and $0.07. The UTXO Realized Price Distribution (URPD) tracks these price clusters, which are key support or resistance zones.

Many holders came in around $0.20, which could mean more selling pressure at that level as some will aim to break even or cash out profits. If DOGE can break above it with substantial volume, it could lead to further upside.

However, if buyers hesitate, this may also prompt short-term resistance and consolidation. Combined with the cup pattern mentioned before, this level could be a very important turning point.

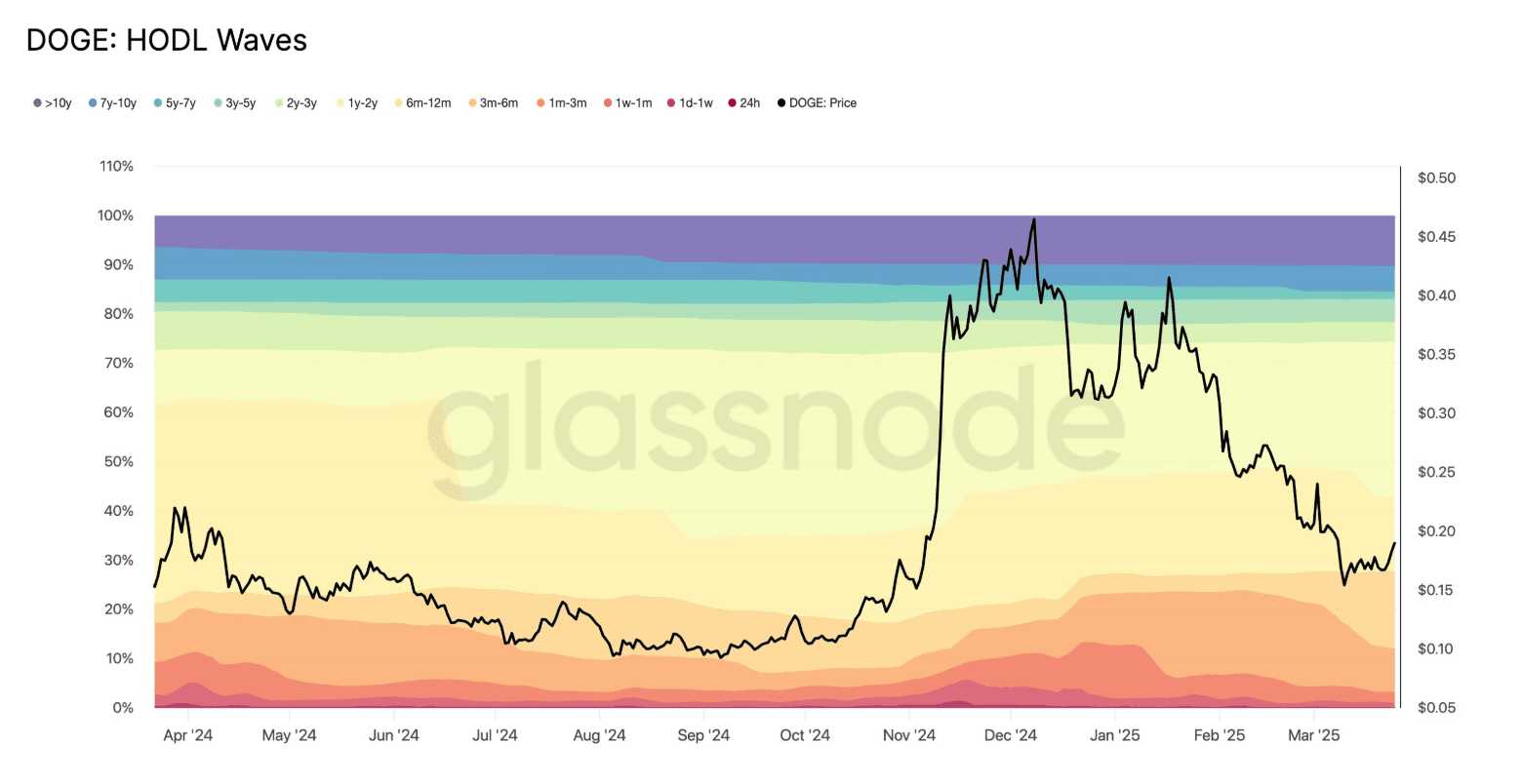

HODLers Continue to Show Patience

Moreover, the 15% of DOGE’s supply was last moved 6 months to 12 months ago, per Glassnode’s HODL Waves. These holders bought before the late 2024 rally and did not sell during the recent correction.

This holding behavior represents confidence, especially as long-term holders help alleviate selling pressure during volatility. The data also reveals a good mix of short-term and long-term holders, which may help stabilize DOGE’s market in the future.

The combination of spot demand, low leverage, technical structure, and holder behavior makes the coming weeks critical as DOGE approaches the $0.20 level.