- Texas may soon allocate $500 million annually to Bitcoin, potentially becoming the first U.S. state with a BTC reserve.

- Arizona advances two crypto-related bills, while Oklahoma’s failure to pass similar legislation halts its crypto reserve ambitions.

- Globally, from Trump’s federal Bitcoin reserve order to Czech and Iranian strategies, nations are rapidly integrating crypto into policy.

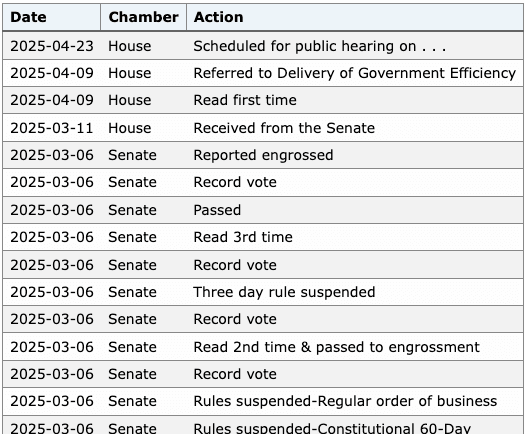

Texas will hold a public hearing On April 23, 2025, to discuss a bill that suggests the establishment of an annual Bitcoin reserve of $500 million. The bill, which is currently advancing through the state legislature, would cause a major financial revolution if approved, thus overtaking Texas as the first U.S. state to have Bitcoin as a reserve in an official capacity.

Crypto analyst Crypto Rover posted the update on Texas Bitcoin Reserve plans. If it works out, the plan is supposed to let Texas spend $500 million every year to procure Bitcoin and use it as a strategic reserve. The release of the new plan has led to the price of Bitcoin on the market to increase slightly by almost 1%, surpassing the $85,000 mark.

States Diverge in Crypto Strategy

Even if there was no Texas hearing, the state had been seeing an increase in momentum already. Arizona was the front-runner in presenting two comprehensive legislative measures, namely, SB 1373 and SB 1025. SB 1373 is designed to launch a Digital Assets Strategic Reserve Fund promoting digital assets for a maximum of 10%.

On the other hand, SB 1025 is about Bitcoin only and allows the state’s treasury and retirement system to invest a similar 10% into the asset, thus creating a BTC ecosystem. Both bills have passed committee hurdles and are now approaching final votes.

As of now, Arizona is on the move; Oklahoma, in contrast, has made a different decision. House Bill 1203 was not passed by the state’s Senate Revenue and Taxation Committee by a very small vote. The bill was aimed at creating a Bitcoin reserve, but the rejection is basically the end of Oklahoma’s involvement in this growing trend.

Federal and Global Fronts Join the Fray

On the federal level, President Donald Trump is now backing a broader initiative. In March 2025, he signed an executive order directing the creation of a national Strategic Bitcoin Reserve. This federal plan includes cryptocurrencies such as Ethereum, Solana, Cardano, and Ripple, in addition to Bitcoin.

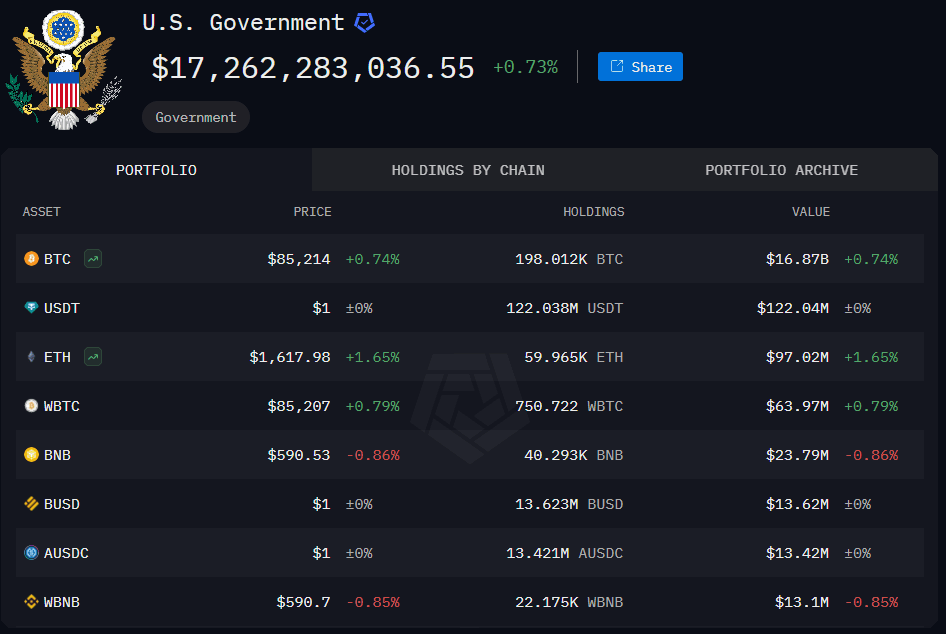

Trump’s Bitcoin reserve strategy plans to use lawfully seized crypto assets, and the U.S. government already holds over 198,000 BTC, according to on-chain analyst Arkham Intelligence.

Meanwhile, on the international stage, the Czech National Bank is weighing whether to allocate up to 5% of its €140 billion reserves into Bitcoin. CNB Governor Aleš Michl supports the move as a diversification step, though the institution is still debating the risks, including price volatility and regulatory concerns. A formal report on this plan is expected in October 2025.

Outside of the big economies, smaller nations are diving in more decisively. El Salvador, a long-time Bitcoin advocate, has amassed more than 6,000 BTC in its national reserves. Bhutan, using state-controlled mining operations, has gathered roughly $750 million in Bitcoin, making up 28% of its GDP.

Iran has taken a more regulatory-driven route. The country now requires all domestic Bitcoin miners to sell their output directly to the central bank. This policy has woven Bitcoin into its national import payment infrastructure, giving the cryptocurrency a direct role in its trade and economic planning.