- Bitcoin rallied strongly earlier in the year, even crossing above the $100,000 mark after Donald Trump’s inauguration as US president.

- According to CryptoQuant CEO Ki Young Ju, the bull market might be over, and the market will likely trend lower over the medium term.

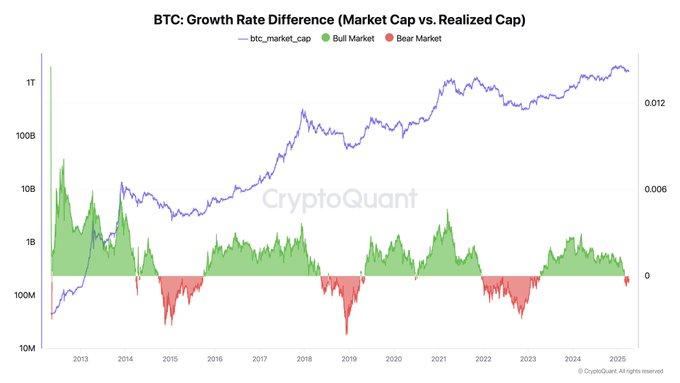

- Bitcoin’s realized cap shows that a bear market is here, and the inability of new capital to lift its price is now as clear as ever.

Bitcoin rallied strongly earlier in the year, even crossing above the $100,000 mark after Donald Trump’s inauguration as US president. However, soon after this, the leading cryptocurrency entered what appears to be a fresh new bearish phase. Prices have since fallen below the $80,000 mark, and the real story now lies beneath the surface.

What does the crypto market’s Realized Cap metric have to tell us? Has the bull market really ended? Here’s what CryptoQuant CEO Ki Young Ju has to say.

Understanding Realized Cap vs. Market Cap

Ki Young Ju took to X sometime over the weekend to share something interesting about the crypto market. According to the analyst, the bull market might be over, and the market will likely trend lower over the medium term. To understand Young Ju’s perspective on the matter, it helps to understand the difference between Market Cap and Realized Cap.

To start with, market cap is calculated by multiplying the latest traded price by the total supply of Bitcoin. In essence, “market cap” is “current price” times “circulating supply.” This metric shows the current paper value of the entire Bitcoin market.

On the other hand, Realized Cap shows how much actual capital has flowed into Bitcoin. It measures the price of BTC at the time it was last moved into a wallet (assuming that’s when it was bought). When this price is multiplied by the number of coins held, it yields a value that reflects the amount of real-world economic activity more clearly.

To put things simply, Market cap tends to fluctuate wildly based on sentiment and the depth of Bitcoin’s order books. On the other hand, Realized Cap shows how much genuine interest investors have in the ecosystem.

Small Capital Moving Prices equals Bull Market

To put things further into perspective, a healthy bull market typically sees investors pushing prices up quickly. This means that not very many people are selling, and more people are interested in buying.

However, the current behaviour of the market shows a different story. Fresh capital is entering the market, which we can see through the rising Realized Cap.

Despite this, Bitcoin’s price isn’t moving upward for some reason. This, according to Young Ju, is a strong bearish signal. It means that there are simply too many sellers at the moment.

When sell pressure rises, even large inflows fail to move prices. This is exactly what happened when Bitcoin hovered near the $100,000 zone and began to drop sometime in late January. Despite the high trading volumes, the price barely budged. Now that Bitcoin is trading below the $80,000 zone, the inability of new capital to lift its price is even clearer for all to see.

A Closer Look at Current Market Conditions

Since the market peaked above the $100,000 mark late last year, Bitcoin has failed to reclaim this high. By 7 March, it had slipped below $90,000, and its downward momentum hasn’t yet slowed down. The most recent dip below the $80,000 zone shows that bearish market sentiment has taken hold, and investors must be cautious.

Another major problem for the bulls is Donald Trump’s tariffs and how they have influenced the macroeconomic environment. These tariffs being rolled out seemingly every week have put more pressure on risk assets, including crypto. Investors are now bracing for higher prices across the market, as well as a full-blown trade war and Bitcoin is feeling the heat.

Historically speaking, bear markets tend to last at least six months after a peak, or even longer. This means that even if the sell pressure eases, any true reversal would still be several months away. Critics might argue that not all capital flows show up on-chain, especially those involving derivatives or off-chain exchanges.

However, according to Young Ju, most significant activity like ETF purchases, institutional movements and exchange wallet transfers, tends to show up on-chain. This means that while no metric is perfect, the Realized cap tells a scary story, and investors must consider the facts.