- Recession odds soared on prediction markets after Trump’s tariff policy this week.

- On PolyMarket, recession odds surged from 39% to 52% in under 24 hours this week.

- Despite sell-off, Bitcoin hedges inflation; Bitwise keeps $200,000 year-end target.

The US economy could be in for some serious trouble. According to reports, the probability of a recession has now skyrocketed on several prediction markets. This comes soon after President Donald Trump’s latest tariff policy this week.

Economic uncertainty is gripping investors so far, and questions are beginning to rise about how this will affect the global markets, especially as inflation concerns continue to affect Bitcoin’s price.

Rising Recession Odds and What the Markets Are Saying

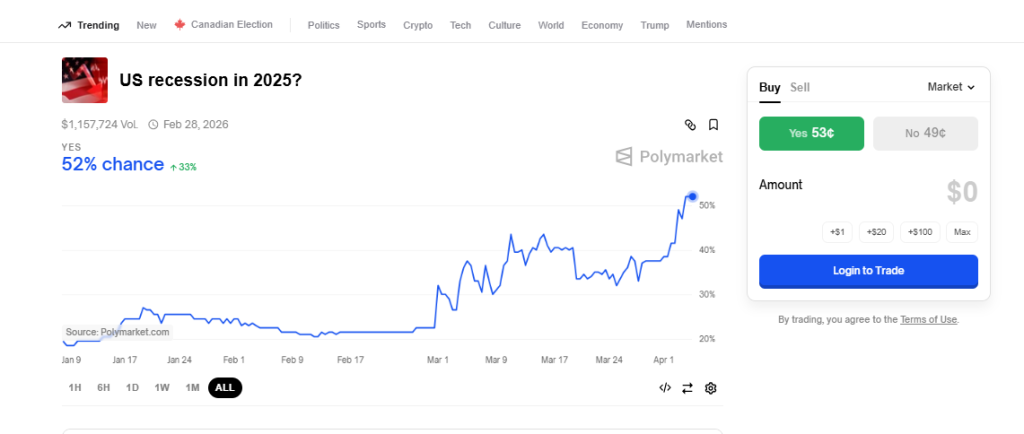

Since the US presidential election campaigns from last year, prediction markets have been known for correctly forecasting some of the biggest macroeconomic events. As it stands, these markets are now showing a greater-than-50% chance that the U.S. will enter a recession before the end of the year. On PolyMarket for example, the probability of a recession jumped from around 39% to as high as 52% in under 24 hours this week.

The same happened on Kalshi, which has seen similar odds climb from around 40% to 54%. In addition to these concerns, Myriad Markets odds sit at around 53.6% and are reinforcing the fears of an incoming economic downturn. The massive jump in recession expectations comes just as Trump unveiled an even harsher tariff plan this week, which many economists are warning could destabilize the economy.

The Effects of Trump’s Tariffs on the Economy

Wednesday this week, saw the Trump administration announce a sweeping tariff policy that sets a base rate of 10% on all U.S. imports. In addition, higher taxes were imposed on as many as 60 nations, with China taking the hardest hit with a total 54% tariff after combining the new 34% levy with the existing 20% charge. The base tariffs from the US are expected to take effect on 5 April, with even more tariff hikes on 9 April.

The White House continues to argue that these tariffs will help to correct the US’ trade deficits and promote domestic manufacturing. On the other hand, many economists disagree and have pointed out that higher tariffs tend to raise costs for consumers and businesses. This combination fuels inflation and reduces spending power and if China or the European Union chooses to retaliate, it could spark a full-scale trade war.

How Financial Markets are Reacting

The Wednesday announcement sent shock waves through the financial markets, as expected. For example, the S&P 500 futures crashed by around 3%, as investor anxiety became even more apparent. The tech-focused Nasdaq and the S&P 500 index closed the day with nearly 6% and 5% crashes, respectively.

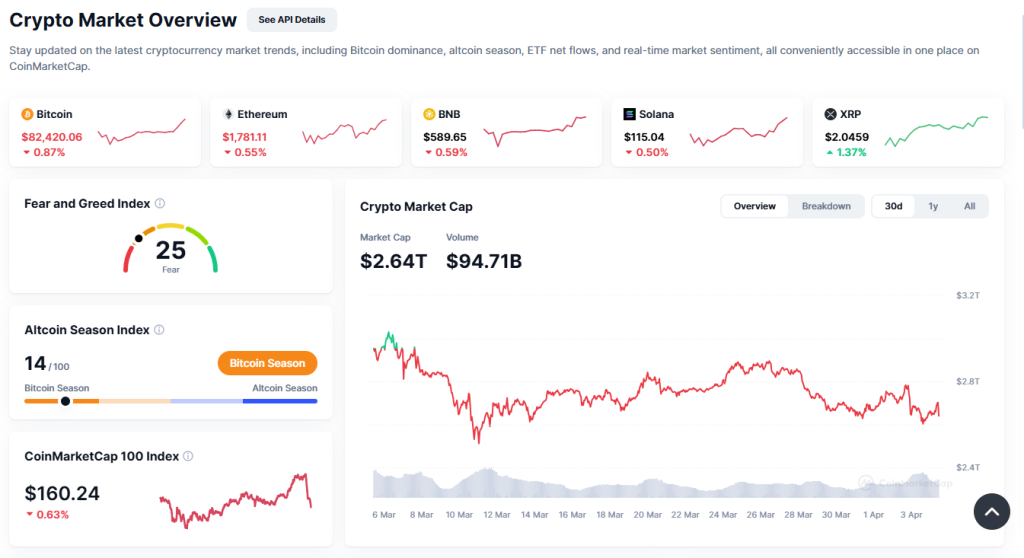

Interestingly, Bitcoin, which is often touted as the ultimate hedge against market turmoi,l was not spared from this downturn, with a retest of $81,000 coming into play on Thursday. Other major cryptos suffered as well, with the total crypto market losing $200 billion in value this week alone. Despite the sell-off though, Bitwise has maintained its $200,000 year-end price target for BTC.

Bitcoin remains solid as one of the biggest hedges against inflation and if the Federal Reserve initiates rate cuts from here, investors could develop more of an appetite for risk assets. Overall, the future of Bitcoin and how it might react to these factors remain to be seen.