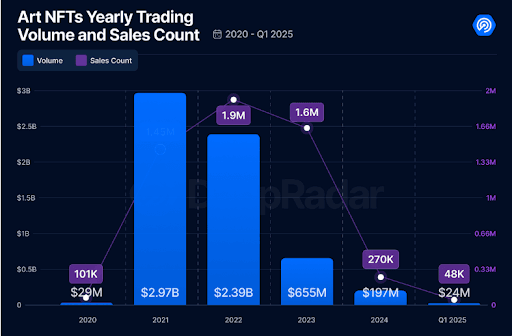

- Art NFT trading volume peaked at $2.9B in 2021 but dropped 93% to $197M by 2024, with further declines in 2025.

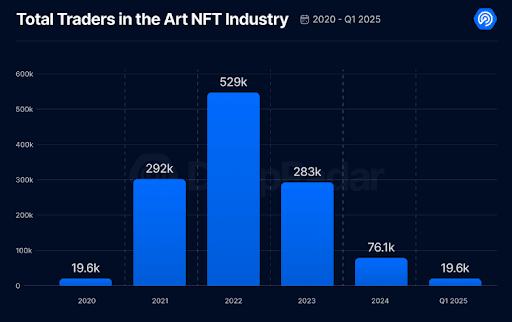

- Active NFT traders peaked at 529K in 2022 but fell sharply to 19.5K by Q1 2025 due to market corrections and declining hype.

- Platforms like MakersPlace shut down, while Art Blocks and SuperRare saw trading volumes drop by 95% and 94%, respectively.

A few years ago, NFT Arts was a trending topic in the Web3 industry, setting the tone for an unprecedented NFT boom. The sector experienced exponential growth between 2021 and 2022; new financial streams opened, and the number of digital artists grew. As a result, traditional arts saw growing mainstream interest and niche growth.

The COVID-19 pandemic also fueled the growth of Art NFTs, as digital platforms became the primary medium for artists to showcase their crafts. However, three years later, the Art NFT frenzy has seemingly cooled. This article analyzes the Art NFT trends and other relevant metrics to determine its potential trajectory.

Trends in Art NFT Trading Volume

Art NFTs launched on Ethereum in 2020, recording $28.7 million in trading volume and 101,000 in sales. The succeeding year, trading volume surged over 10,000% to hit $2.9 billion. In that year, the sector posted record-breaking sales and fees.

For instance, Beeple sold the “Everydays: The First 5000 Days” and “HUMAN ONE” NFT art for $69.3 million and $28.9 million, respectively. Other record sales include “Crossroad” by Beeple and “Ringers #109” by Dmitri Cherniak, which were bought for $6.6 million and $6.93 million, each.

However, the market was hit hard by a major correction in 2022. Although sales increased by 31%, the trading volume dropped 19% to $2.38 billion in that period. Sale prices began to drop as the sector’s hype waned.

Over the next two years, the sector’s trading volume tanked by 93% from its all-time high to $197 million, and sales volumes slipped significantly. Engagement dropped further in 2025, as trading volume stood at $23.8 million.

The Shifting Value of Art NFTs Across Market Cycles

NFT Arts traded at peak value in 2021, with average sale prices pegged at $2,044. Large bids and high market competition mainly fueled the surge. As the market corrected the following year, this price was slashed by 39%, dropping to $1,251. Despite a dip in trading volume, NFT prices experienced a 79% rally compared to their 2023 value. Market commentators believe that this price recovery correlates with the drop in sale numbers.

Looking at the on-chain price trend, Ethereum dominated the NFT market, with average prices reaching $2,141.17 during the first year. However, the price saw consecutive declines in 2022 and 2023, falling to $1,399.08 and $475.37. The NFT price recovered to $1,273.09 before settling at $645.34 in the succeeding year.

Bitcoin’s Ordinals debuted in the NFT market with an average price of $63.45 in 2023. As Bitcoin’s price surged, the value of Ordinals surged accordingly, reaching $559.05 in 2024 and $633.24 in Q1 2025.

The Rise and Fall of NFT Traders

During the 2021 boom, the NFT market saw an influx of traders driven by the initial market frenzy and massive adoption. In that year, active traders clocked in at 291,724, a massive 1,386% rise from the 2020 figure of 19,615. This figure was down due the the high media attention, high demand, and fewer art sales to match up.

By the next year, the market peaked at 529,101 active traders as maintain stream adoption increased astronomically. However, during the 2023 market correction, these numbers dropped to 282,683 as buyers became cautious. The deline persisted in the years that followed, dropping to 76,176 and 19,575 in 2024 and Q1 2025, respectively.

Market Correction and Evolution of NFT Arts

Several NFT projects have witnessed similar fates over the years, with some shutting down. Art Blocks’ trading volume has dipped 95% from its 2021 peak as sales value slipped 88%. SuperRare has also also 94% in trading volume and 98% in sales. Meanwhile, Foundation has seen a 100% wipeout in sales as trading tanked 99.8%.

Unfortunately, platforms such as MakersPlace and KnownOrigin have folded. By 2024, about 95% of the 2021’s top 20 most traded Art NFT collections had recorded a decline in both trading volume and sales.

Experts note the NFT Arts trend is influenced by factors such as speculative buying and whale manipulation. As such, a market correction was inevitable. However, they maintain that the NFT market isn’t dead; rather, it has evolved and settled into a more realistic valuation.