- Bitcoin’s current bull cycle lacks past enthusiasm, with weaker short-term holder activity and lower transaction movements than previous peaks.

- Institutional investors, driven by Bitcoin ETFs, now lead market trends, replacing the retail frenzy of previous cycles.

- Liquidity constraints and higher interest rates slow Bitcoin’s growth, signaling a longer and steadier market evolution.

The momentum is fading in the current Bitcoin bull cycle. The leading cryptocurrency is now trading at $85,606, marking a 1% gain in the last 24 hours — 215 low from its all-time high on January 20. However, the enthusiasm is not in line with the current bull cycle. If we look back to 2017 or 2021, there was much of a frenzy on Bitcoin bulls, but now it’s quiet.

CryptoQuant contributor Crypto Dan captured the boring cycle, writing:

“In previous cycles, the market would heat up quickly. We saw strong pumps and a surge in short-term holders entering the space. But this time, despite price increases, the overall sentiment feels unusually quiet.”

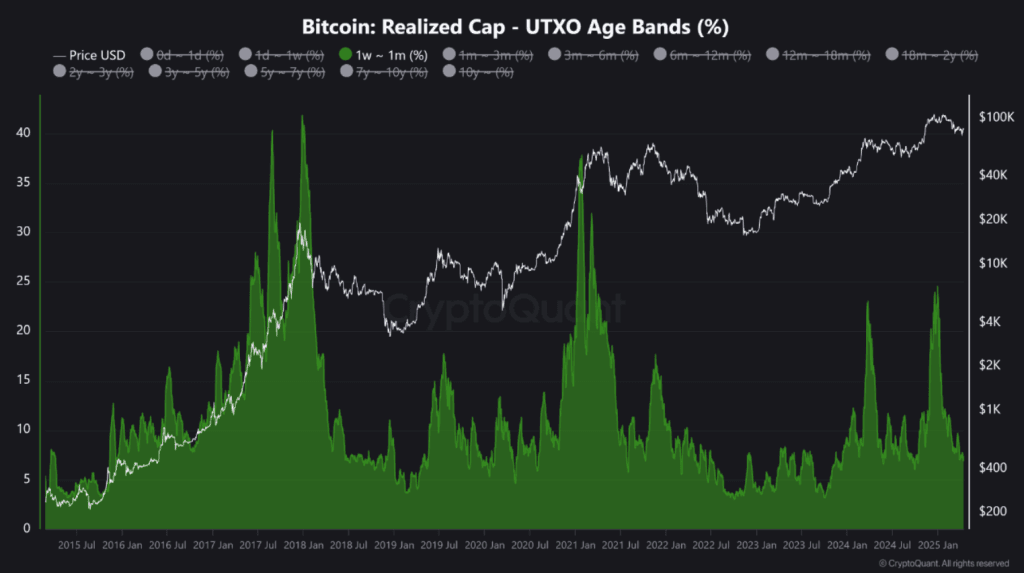

Dan’s analysis shows that Bitcoin Unspent Transaction Outputs (UTXOs) aged between 1 week and 1 month are comparatively lower than what was observed in earlier cycles. To put it simply, there is a significant absence of fast-moving new entrants. Looking at historic cycles, metrics are evident of huge spikes whenever Bitcoin hit new heights, like in late 2017, early 2021, and mid-2024.

Institutions In, Retail Out – And That’s Changing the Game

Why has this enthusiastic run become such a rare event? In fact, it’s a regime of the deeper market leadership. Retail traders who ignited the market before have now been replaced by some major players. There are more serious investors in the market thanks to Bitcoin ETFs. Now, the market goes up in an organized manner due to the introduction of the flow structure.

This is no longer a market of adrenaline-pumping highs and sudden drops. It’s a steadier environment—one that may feel boring to short-term chasers but is no less significant.

Dan noted:

“This flow creates a step-by-step, gradual uptrend centered around Bitcoin, rather than the rapid, euphoric rallies seen in the past.”

Meanwhile, short-term activity is picking up again. CryptoQuant’s charts show a noticeable spike in UTXOs between 1 week and 1 month, possibly hinting at profit-taking or traders bracing for volatility. This behavior often comes before dips, and that pattern held true in 2024 just as it did in past peaks.

New Cycle Emerges with Slower Bitcoin Growth

One of the main factors cooling off the mood is liquidity—or the lack of it. In the 2020-2021 rush, the availability of cheap loans and the fact that interest rates had come down to almost 0% made it possible for the market to rise sharply. Now, because of the high interest rates and decreased financial possibilities worldwide, funds are not moving around the markets as quickly as before.

But that doesn’t mean the cycle is dead. It might just be transforming. Some indicators even suggest that the peak is behind us, but that conclusion could be too hasty. If anything, Bitcoin may be entering a slower, longer-lasting growth phase.

Dan pointed out the importance of adjusting expectations: “This cycle may not follow the old pattern of sharp rise followed by crash. Instead, we could be in the middle of a longer, more complex market structure.” That structure demands patience over hype.

Bitcoin Nears $100K—Why ETF Inflows Stay Strong Despite Slow Pace

Despite the sluggish movement, ETF inflows show no sign of decline and remain robust. The long-term conviction is in a fight with the short-term temptation, with Bitcoin moving closer to the $100,000 psychological mark. Strategic rebalancing prompts one to hold on to the majority of the shares and sell only a few, only if profits are desired to be trimmed.

In the short-term UTXO history, one thing is for sure that the sharp spikes of UTXOs signal not only the action but also the heightened attention of the investors. As interest rates finally climb down, the money will be able to circulate freely once again. If this happens, 2025 might be the time for more happenings but with less mass confusion.

“In times like this, what matters most isn’t chasing quick pumps—It’s understanding the slower structure and having the patience to stay with it,” Dan sums tha analysis.