- ETH lately rallied beyond the $2.2k resistance and is now registering a 20% weekly gain according to the latest price data.

- One of the biggest Ethereum-related headlines this week, was the $3.5 million Ethereum purchase by World Liberty Financial.

- Analysts have eyes on the $2,380 resistance. If ETH breaks through, it could create a new wave of bullish sentiment and lead the altcoin market higher.

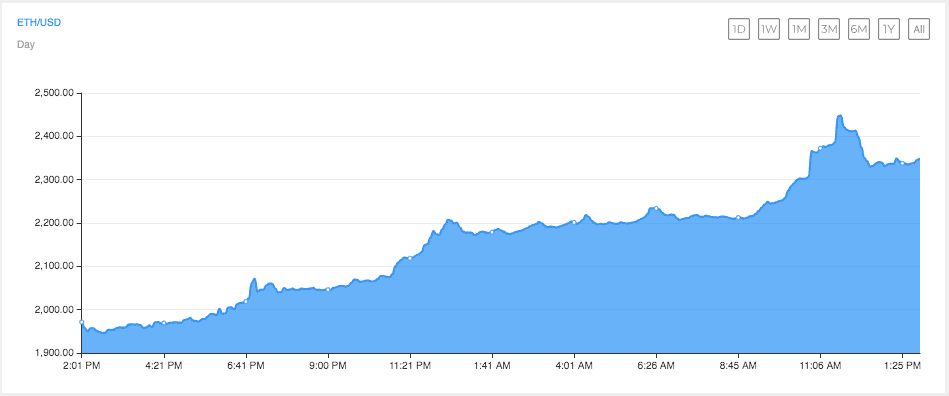

Ethereum is in the middle of a powerful moment, especially after spending weeks lagging behind the rest of the market. ETH lately rallied beyond the $2.2k resistance and is now registering a 20% weekly gain according to the latest price data.

Moves from Donald Trump-backed World Liberty Financial might have been behind this surge, and on-chain signals are showing that sentiment has shifted. However, the question remains: How high can Ethereum go from here?

Institutional Whales Are Jumping In

One of the biggest Ethereum-related headlines this week, was the $3.5 million Ethereum purchase by World Liberty Financial. This Trump-affiliated platform added 1,587 ETH to its portfolio, in a show of bullish interest.

However, while the World Liberty Financial purchase made headlines, other institutional investors jumped in as well. For example, financial powerhouse Abraxas Capital extracted 49,644 ETH (≈$92M) from Binance and Kraken exchanges. These withdrawals are typically seen as bullish, since they indicate that these investors do not have an interest in selling their crypto. This institutional accumulation fits in nicely with the general uptick in Ethereum’s trading volumes, which has more than doubled in the past 24 hours to over $38 billion.

The US-UK Trade Deal And Pectra

Another major factor that pushed the price of Ethereum upwards was the announcement of a new trade deal between the United States and the United Kingdom. The agreement features reduced tariffs between both, and is a great step on the path towards smoother cross-border transactions.

This deal appears to have created fresh demand for Ethereum and crypto in general, reports showing a $1.8 billion injection of new capital into Ethereum markets. On-chain data supports this trend with a strong decline in ETH reserves on exchanges by 132,000 ETH in just four days and 323,000 ETH since late April.

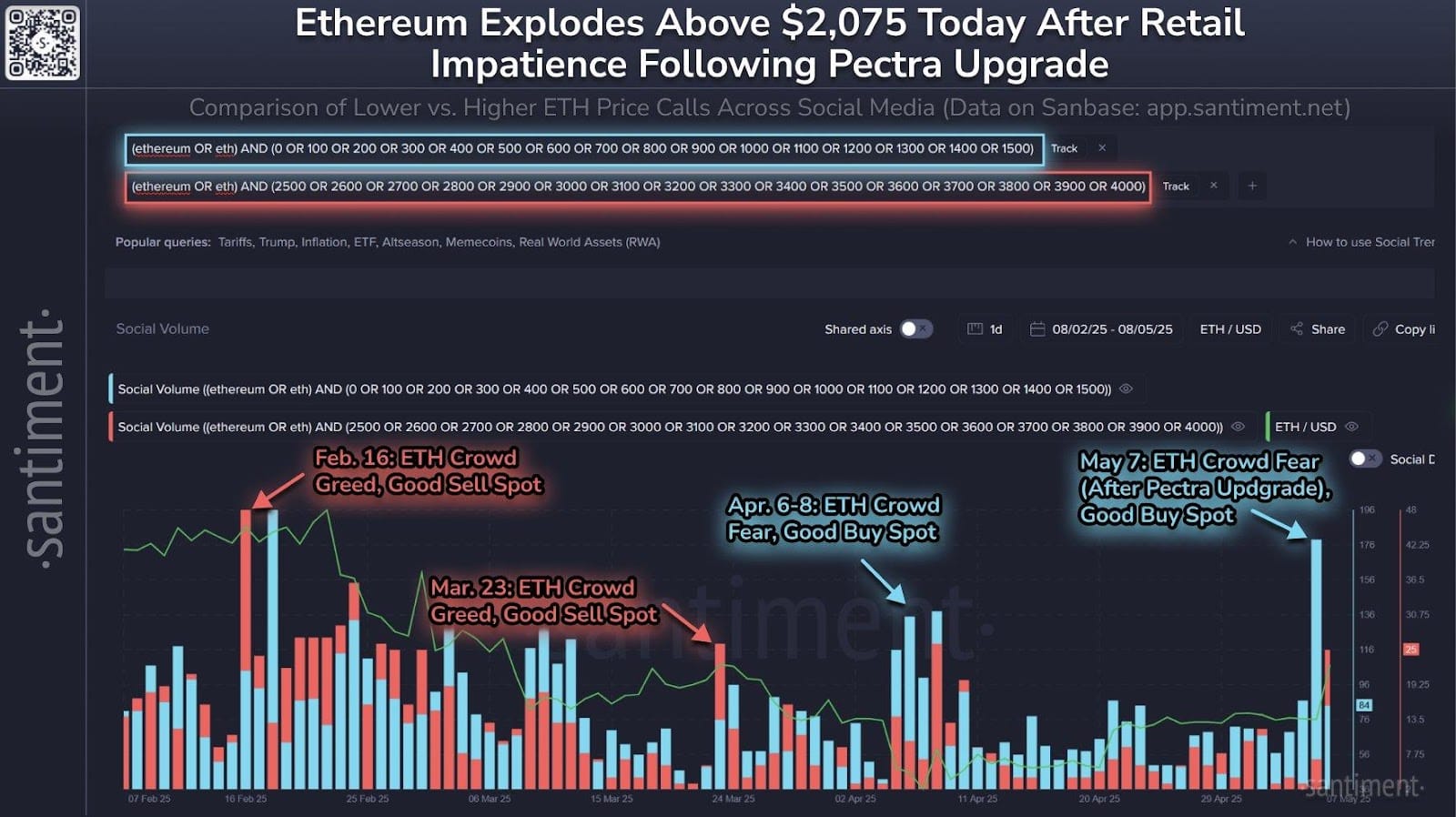

Santiment also jumped in with post-Pectra data on Twitter (now X). According to the on-chain analytics platform, this upgrade, which went live on 7 May, introduced “a textbook example on how it pays to be a contrarian against the retail crowd.” Santiment noted that while many traders expected the upgrade to be a “sell the news” event, Ethereum has gone against all odds and surged past the $2,075 zone for the first time in over 6 weeks.

Interestingly, the Ethereum Foundation announced $32.64 million in grants for ecosystem development after the Pectra upgrade. These funds will support areas like cryptography, zero-knowledge proofs, consensus mechanisms, and developer tooling in a show of Ethereum’s dominance as the top smart contract platform.

Analysts Weigh In

Analysts are starting to weigh in on the current price action of Ethereum. For example, Ali Martinez recently identified the $2,380 level as a major supply barrier. The analyst believes that if ETH can break above this resistance, it could spark a new rally and take Ethereum closer to $3,000 in the near term.

Captain Faibik, another analyst, pointed out a broadening wedge on Ethereum’s charts, alongside a confirmed breakout. The analyst says that Ethereum had spent 5 months in consolidation before this breakout, and the cryptocurrency is now eyeing the $3,840 mark.

Another respected analyst, Rekt Capital, believes that the recent price movement is similar to a pattern from late 2019. According to him, ETH could fluctuate between $2,200 and $3,900 over the next few months, especially if macro conditions remain favorable. At the moment, watching $2,380 resistance will be critical. If ETH breaks through, it could create a new wave of bullish sentiment and lead the altcoin market higher.