- Brazil cements its crypto leadership with XRPH11, debuting the world’s first spot ETF tied directly to XRP.

- XRPH11 tracks the Nasdaq XRP Reference Price Index and offers real-time pricing based on major global crypto exchanges.

- Despite XRP having roots in the United States, American investors have yet to see any indications of a spot XRP ETF.

The crypto market has just experienced another win this week, with Brazil officially launching the world’s first XRP ETF. This new exchange-traded product will give investors regulated access to one of the most popular cryptocurrencies on the market. Brazil has emerged as a global hub for crypto finance, taking the lead in driving worldwide cryptocurrency adoption. Here’s what this new ETF approval means for the industry and why the US might be next in line.

The World’s First Spot XRP ETF

The XRPH11 launched on 25 April, debuting on Brazil’s B3 exchange. It began trading on 25 April on Latin America’s largest stock exchange, which happens to be Brazil’s B3 exchange. The XRPH11 is issued by Brazilian asset manager Hashdex and is set to be managed in partnership with Genial Investimentos, while Genial Bank SA serves as the custodian.

XRPH11 tracks the Nasdaq XRP Reference Price Index and offers real-time pricing based on major global crypto exchanges. It is unlike futures-based ETFs and directly reflects the current market price of its underlying asset. In essence, it is a regulated, more transparent, and straightforward investment vehicle.

What Makes XRPH11 Stand Out

XRPH11 is a game-changer within the industry due to several features. These include its Direct Exposure, in which about 95% of the fund’s net assets will be allocated to XRP or related digital assets. The fees are also competitive, as investors only pay a maximum annual fee of 0.7% for fund administration, management, and distribution.

Investors also pay an additional 0.1% annual custody fee (without structuring fees). This makes the XRPH11 a lot more cost-effective, compared to traditional financial products.

Hashdex also designed the fund for a special class of investors, especially institutions that want a regulated way to access crypto through the equity markets. With this launch, Hashdex now offers nine crypto ETFs in Brazil, featuring single-asset funds for Bitcoin (BITH11), Ethereum (ETHE11), and Solana (SOLH11).

Interestingly, the Comissão de Valores Mobiliários (Brazil’s version of the SEC) approved the spot XRP ETF in February of this year, after green-lighting a similar spot Solana ETF from Hashdex in 2023. The swiftness in regulation stands in sharp contrast to the US’ approach and shows that Brazil is willing to move forward with products like the XRPH11.

The U.S. Watches Closely

Despite XRP having roots in the United States, American investors have yet to see any indications of a spot XRP ETF. This is especially interesting now that Brazil has beaten the U.S. to market with the XRPH11.

So far, the US SEC has shown signs of softening its stance against crypto, especially after pressure from lawmakers and investors. US President Donald Trump has repeatedly promised to make the U.S. the “crypto capital of the world.”

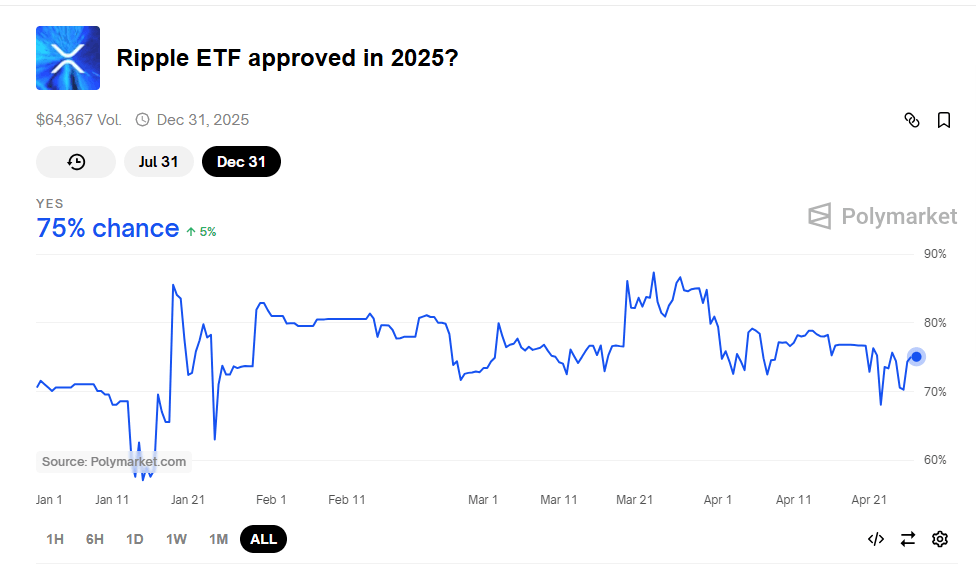

As such, other asset management giants like Grayscale and Franklin Templeton already have similar XRP filings on the SEC’s desk. Still, prediction markets like Polymarket show that there is now a 75% chance that the U.S. is expected to approve a spot XRP ETF within the year.

By mid-April, XRP-focused ETPs held nearly $950 million in assets worldwide, including $37.7 million in fresh inflows within a single week. In the first month of this year, JPMorgan forecasted XRP ETFs could pull in about $8B in net investments. For now, while Brazil holds less than 1% of the global crypto ETF asset base, its XRP ETF launch means that it has a head start over the US while other nations follow suit.