- XRP crashed sharply to $1.67 between Sunday and Monday this week, marking its lowest level since November of last year.

- This crash on XRP was likely caused by the 2 April tariffs introduced by Donald Trump on the so-called “Liberation Day.”

- XRP hovers above $1.29 support, key to its November surge to $3.4.

XRP crashed sharply to $1.67 between Sunday and Monday this week, marking its lowest level since November of last year. So far, the cryptocurrency has lost around 25% of its initial value in a month and is already underperforming in an (already shaky) crypto market.

So what triggered this decline? While many factors are currently in play, the biggest culprit appears to be the escalation in the ongoing trade war sparked by U.S. President Donald Trump.

The Numbers Tell the Story

XRP’s market cap has so far dropped by around 17% to $102.5 billion in less than a month. The most recent decline in its price caused more than a 250% surge in its trading volume to nearly $10 billion, as investors raced to sell.

This crash on XRP was likely caused by the 2 April tariffs introduced by Donald Trump on the so-called “Liberation Day.” These tariffs included 20% on all Chinese goods, 25% on steel and aluminium, additional duties on autos from multiple nations and much more.

The decisions from the US president rattled the financial markets to its core, and within days, the global equities had lost over $7 trillion in value, including $5.87 trillion in U.S. stocks alone.

XRP’s decline likely started as investors saw these signs and de-risked their portfolios. While crypto is often seen as a hedge against issues in traditional finance, the current scenario is very different, with risks of inflation rising and global trade gearing up to take a massive hit.

Investors are becoming more risk-averse, and are now flocking towards safer assets like the US dollar and gold.

XRP’s High Correlation With Bitcoin

More on why XRP is feeling the heat is its tight correlation in price to Bitcoin. Since the COVID-19 pandemic five years ago, this cryptocurrency has shown a strong correlation to Bitcoin (currently around 80% according to IntoTheBlock).

This tight correlation triggered a drop below the $2 mark for XRP, just as Bitcoin dropped 7% to around $77,000 amid the trade war panic.

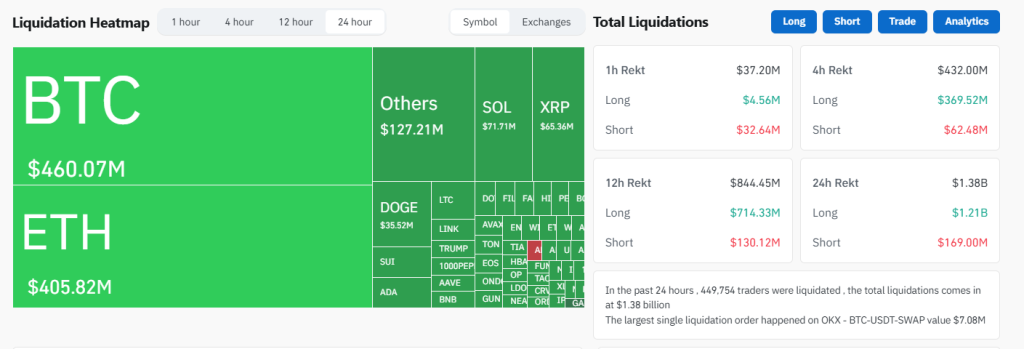

Ethereum, Solana and most other major tokens also saw double-digit losses as well, with more than $1 billion in bullish positions wiped off the board, according to Coinglass.

Through it all, XRP’s share of this liquidation stands at $65 million. Even though this is not as high as Bitcoin or Ethereum’s, it is still strong enough to shake investor confidence.

Support Levels Are Breaking

From a technical standpoint, XRP is in dangerous territory. The most recent crash came just as the cryptocurrency broke out of a head and shoulders pattern, which is generally regarded as a bearish formation.

The cryptocurrency broke below the $2.00–$2.01 support zone over the weekend, which had held steady since December of last year. This breakdown caused a liquidation cascade, with Sunday alone seeing a 10.4% drop before another 12.3% decline on Monday.

Currently, XRP is now hovering above the $1.29 support zone, which served as a launchpad for the cryptocurrency in its November surge to $3.4.

This means that if the $1.69 price level fails to hold, the cryptocurrency could be primed for a revisit of the $1.50 or even $1.00 price levels. On the other hand, if the bulls were to stage a comeback, some resistance zones to watch out for include the $2.01 level, which was a former strong support turned resistance.

More of these include $2.86 to $2.92, which were the December and February price peaks. Finally, the $3.37 price level serves as a resistance, considering its position as the January high. However, considering the current sentiment, a rebound appears unlikely in the medium to short terms.