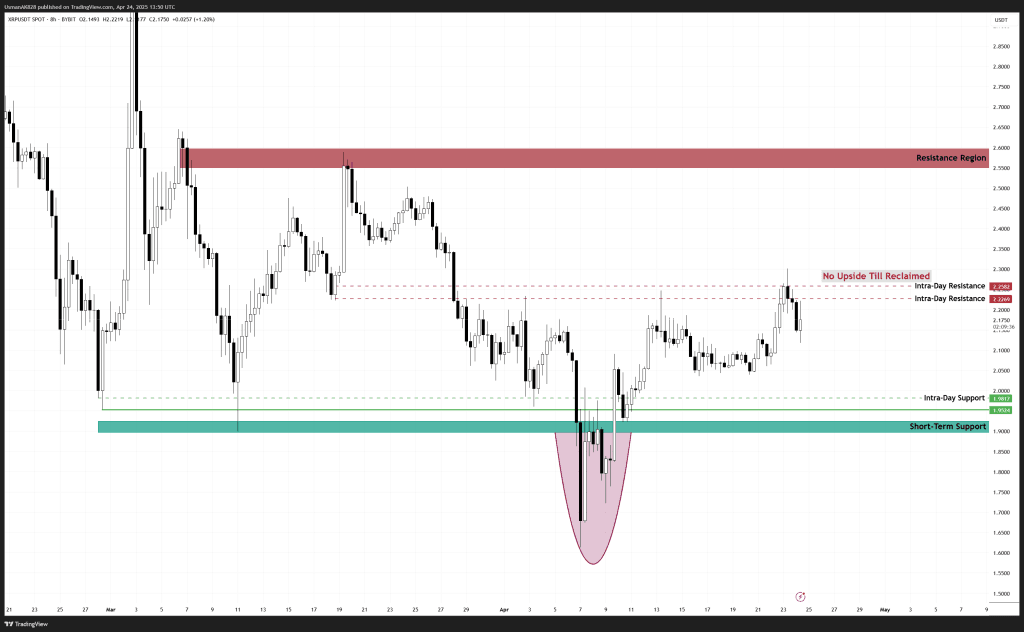

XRP Technical Analysis: 24 APR 2025

XRP is challenging the key intra-day resistances. Source: TradingView

General View

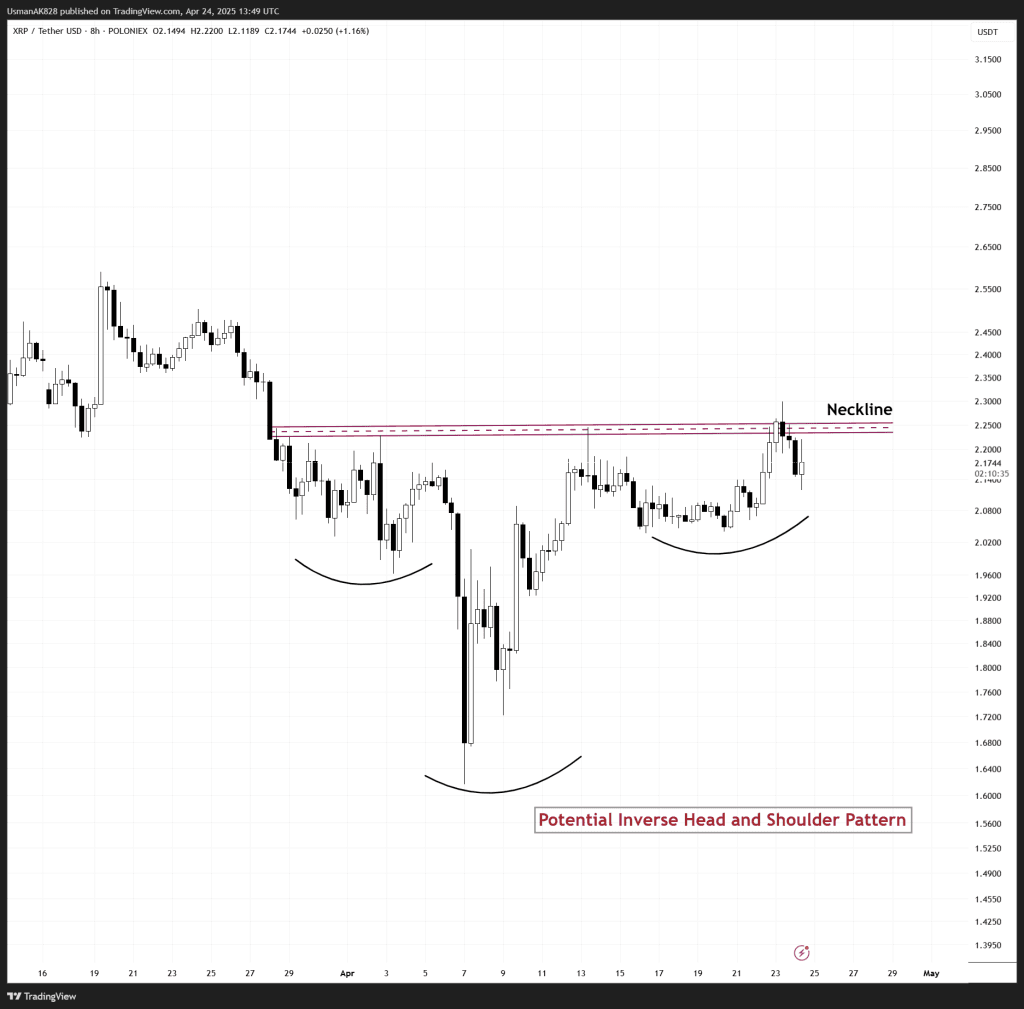

XRP has shown encouraging signs of a potential recovery on the lower timeframes. A possible inverse head and shoulders pattern is beginning to take shape, which suggests a potential bullish continuation ahead. However, the price is currently challenging the neckline zone, a level that aligns closely with the cluster of intra-day resistances that have repeatedly capped XRP’s upside. These levels are now acting as significant roadblocks, and reclaiming them will be key for validating any bullish continuation.

On The Upside

A break and close above the intra-day resistance levels of 2.22 and 2.25 would be the first real sign of bullish strength. Since 28th March, bulls have failed to establish any dominance above this resistance zone. These levels have proven difficult to overcome in previous attempts, however, if they break, XRP is likely to extend its upside initially towards $2.40, followed by $2.55.

On The Downside

Until XRP breaks past the neckline resistance level decisively, there remains the risk of rejection. As for the session, XRP has intra-day support at $2.15, followed by the $2.05 level. Unless a strong rejection is monitored, XRP is unlikely to head any further lower below the $2.05 level for the day.

A potential inverse head and shoulder pattern is appearing on XRP. Source: TradingView