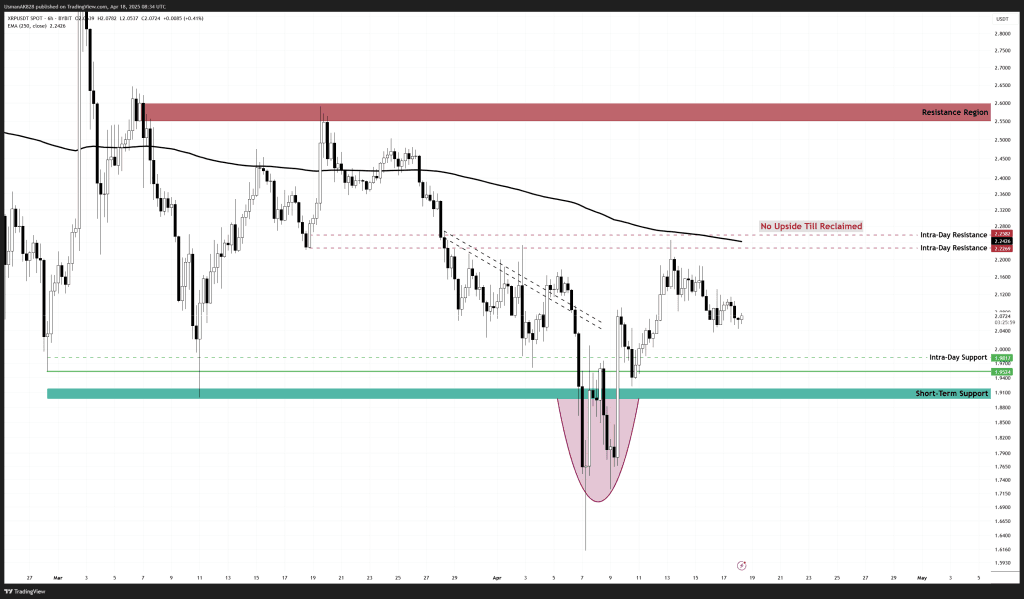

XRP Technical Analysis: 14 APR 2025

XRP must break the EMA-200 level to gain upside potential. Source: TradingView

General View

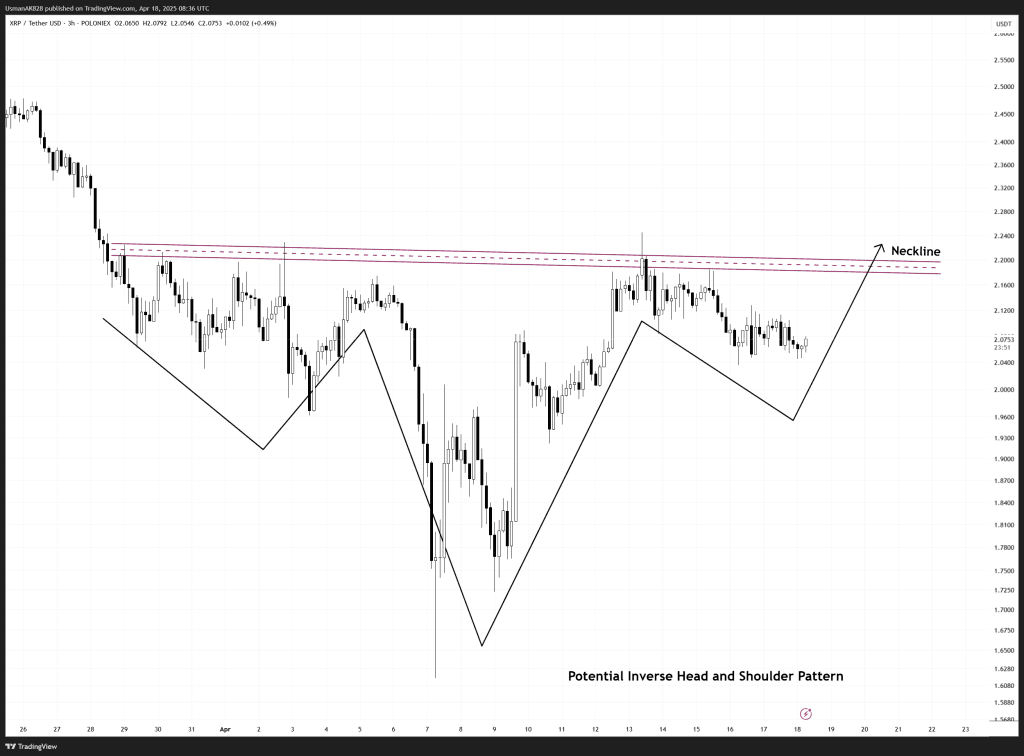

After a major dump, XRP rebounded and has managed to drag itself back inside the congestion zone, but still remains capped under key resistance. This is an important resistance, and unless the bulls break it, there is no upside expected to follow. On the short term, if buyers can maintain pressure in the coming sessions, a push toward the neckline of the inverse head and shoulders pattern could follow. Strength above this neckline would shift momentum and open the path toward higher resistance levels.

On The Upside

Immediate resistance lies between $2.22 and $2.26, aligned closely with the neckline of the potential inverse head and shoulders structure. A clean break and acceptance above this area would likely trigger stronger upside momentum for XRP, which can extend the upside potential towards $2.40 as well as $2.60 levels. But a stronghold above $2.25 is a threshold.

On The Downside

As of now, bulls are holding well, however, continued rejections from the neckline resistance zone could once again tilt the bias back in favor of sellers, who would then once again aim for the $2.00 level primarily and potentially $1.90 next.

Potential inverse head and shoulder pattern appearing. Source: TradingView