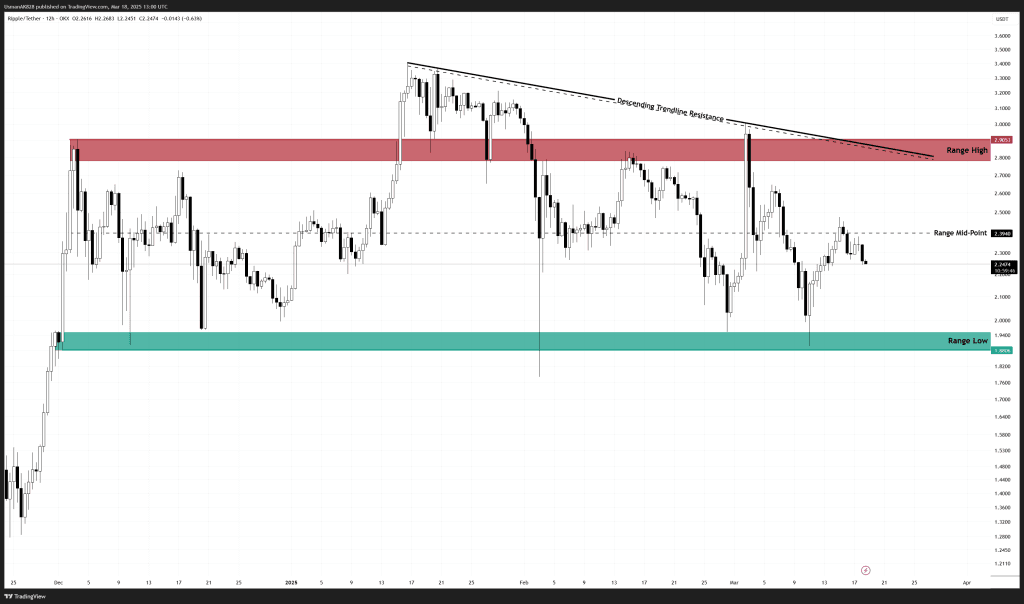

Ripple Technical Analysis: 18 MAR 2025

Mid-range causing a price rejection. Source: TradingView

General View

The price action indicates a battle between bulls and bears, with XRP attempting to regain strength within a defined range. However, the bulls have failed to achieve a breakout above the range mid-level, leading XRP into a profit-taking state. This suggests that traders are securing gains, causing a temporary pause in upward momentum. The larger structure remains under the influence of a descending trendline resistance, capping bullish momentum.

On the Upside

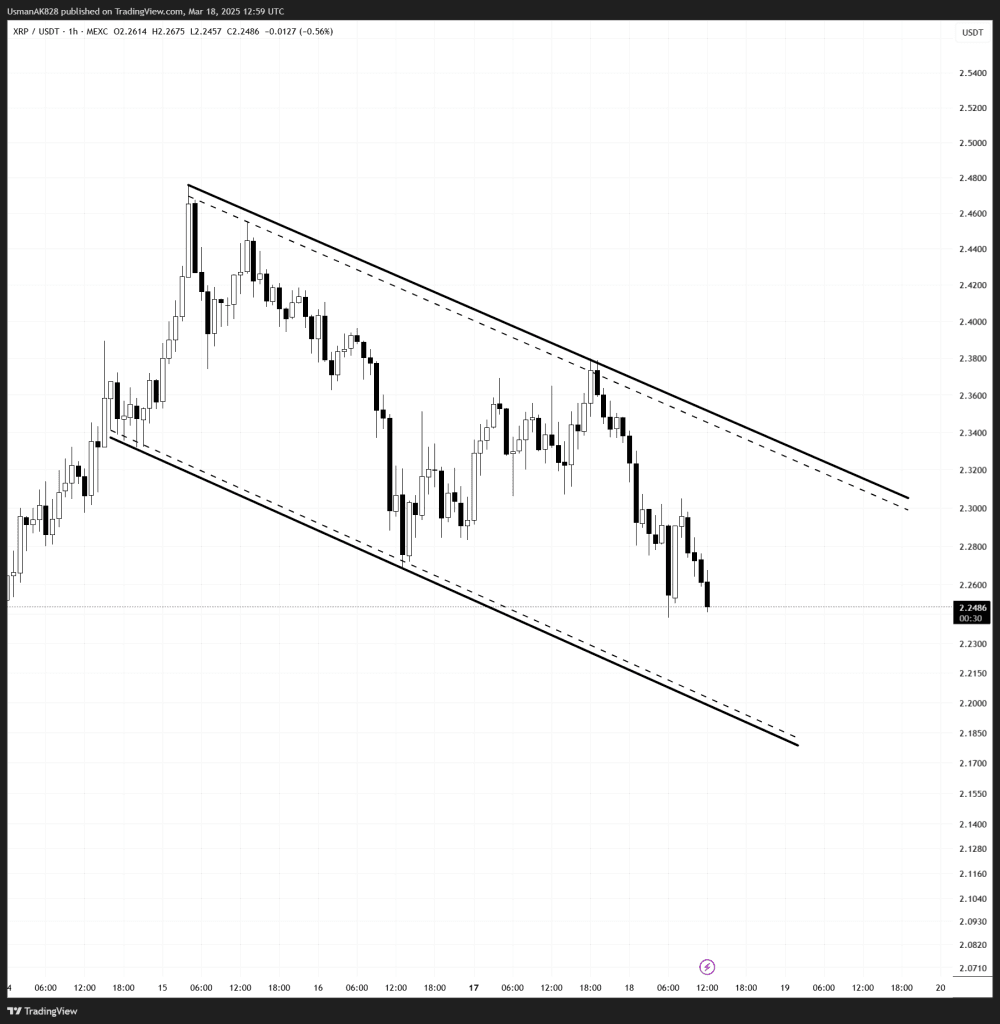

XRP faces multiple resistance levels after its recent rejection, making it challenging for bulls to regain control. The first hurdle lies at $2.28, followed by $2.32, and then the mid-range resistance at $2.40. Each of these levels represents a supply zone where sellers could step in to stall any recovery attempts. Even if bulls manage to push higher, reclaiming the range mid-point at $2.39–$2.40 will be the ultimate test. This level now acts as a major pivot, and without a decisive breakout above it, bullish momentum remains in check.

On the Downside

XRP has partial support at $2.25, but this level lacks strong buyer interest and could easily be breached if selling pressure intensifies. While it may provide a temporary cushion, its weakness suggests that bears have the upper hand in the short term. If sellers overwhelm buyers at $2.25, a deeper slide into the $2.20–$2.15 zone is likely. This area stands as a crucial support for the day, where buyers must step in to prevent further downside. A failure to hold this zone could accelerate selling pressure, exposing XRP to an extended decline.

XRP in a descending trend. Source: TradingView